Financial Analyst Resume Sample

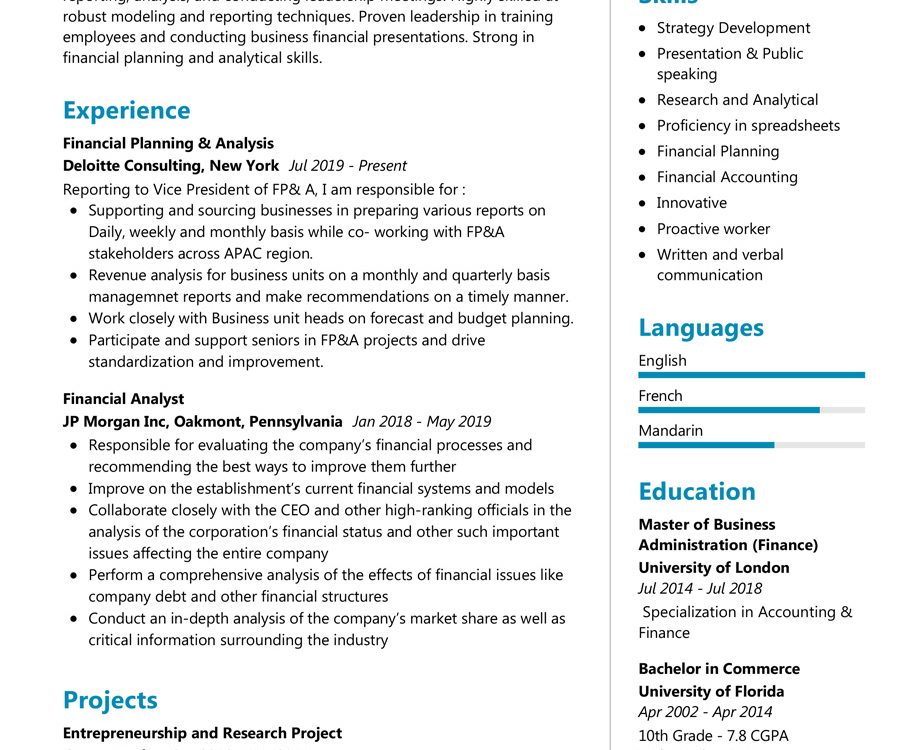

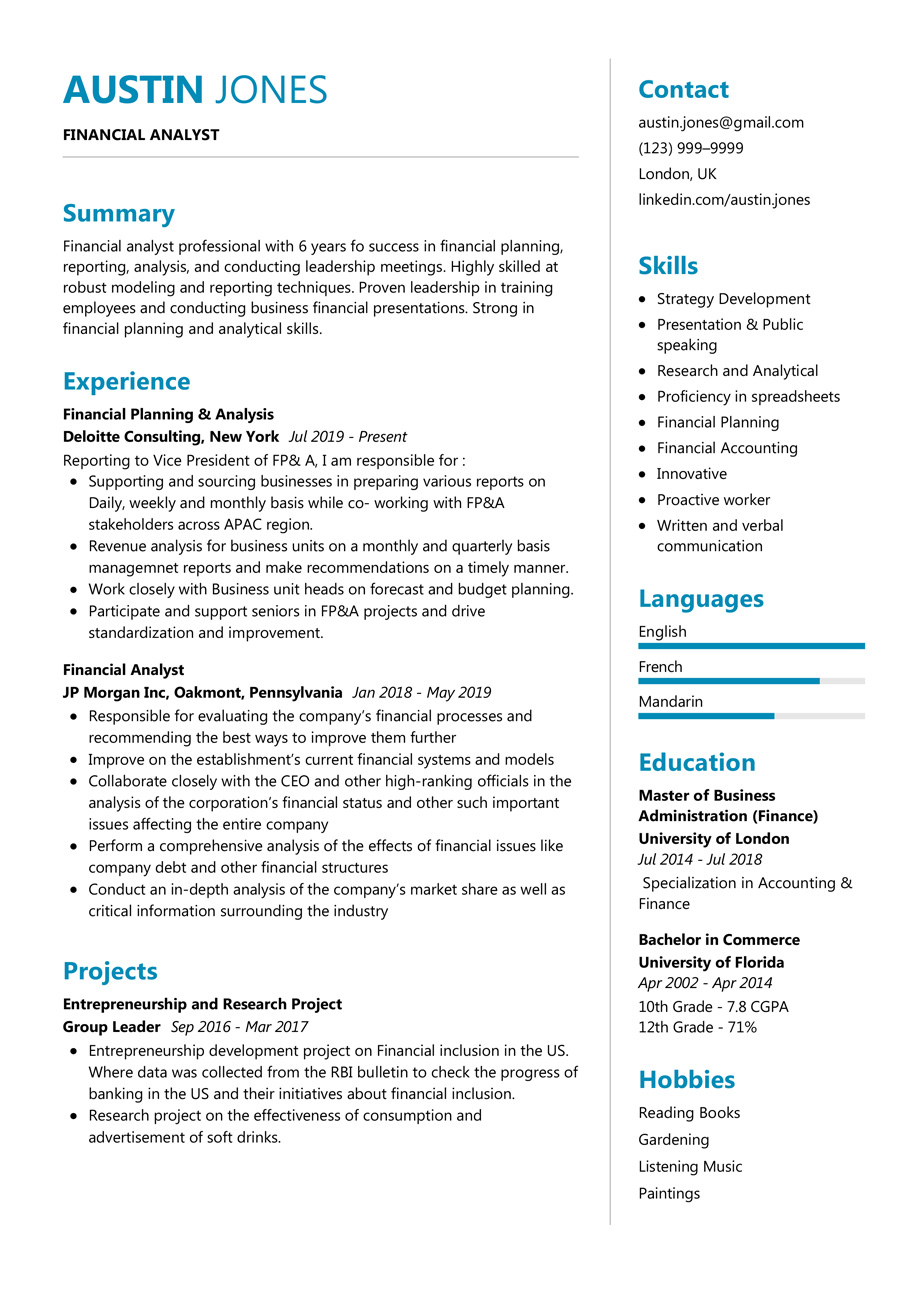

SUMMARY

Financial analyst professional with 6+ years fo success in financial planning, reporting, analysis, and conducting leadership meetings. Highly skilled at robust modeling and reporting techniques. Proven leadership in training employees and conducting business financial presentations. Strong in financial planning and analytical skills.

SKILLS

- Presentation & Public speaking

- Strategy Development

- Research and Analytical

- Proficiency in spreadsheets

- Financial Planning

- Financial Accounting

- Innovative

- Proactive worker

- Written and verbal communication

EXPERIENCE

Financial Planning & Analysis

Deloitte Consulting, New York Sep 2018 – Present

Reporting to Vice President of FP& A, I am responsible for :

- Supporting and sourcing businesses in preparing various reports on Daily, weekly and monthly basis while co-working with FP&A stakeholders across the APAC region.

- Revenue analysis for business units on a monthly and quarterly basis management reports and make recommendations in a timely manner.

- Work closely with Business unit heads on forecast and budget planning.

- Participate and support seniors in FP&A projects and drive standardization and improvement.

Financial Analyst

JP Morgan Inc, Oakmont, Pennsylvania Jan 2016 – Aug 2018

- Responsible for evaluating the company’s financial processes and recommending the best ways to improve them further

- Improve on the establishment’s current financial systems and models

- Collaborate closely with the CEO and other high-ranking officials in the analysis of the corporation’s financial status and other such important issues affecting the entire company

- Perform a comprehensive analysis of the effects of financial issues like company debt and other financial structures

- Conduct an in-depth analysis of the company’s market share as well as critical information surrounding the industry

PROJECTS

Entrepreneurship and Research Project

Group Leader Sep 2016 – Mar 2017

- Entrepreneurship development project on Financial inclusion in the US. Where data was collected from the RBI bulletin to check the progress of banking in the US and their initiatives about financial inclusion.

- Research project on the effectiveness of consumption and advertisement of soft drinks.

EDUCATION

Master of Business Administration (Finance)

University of London Apr 2007 – May 2010

Bachelor in Commerce

University of Florida Apr 2007 – May 2010

Accomplishments

Performer of the Year

JP Morgan Inc Mar 2017

I was the best performer of the year in the financial planning and analysis program.

Languages

Financial Analyst Resume with Writing Guide

The key to success is in knowing how to present yourself. The resume is a reflection of your skills and capacities, so it’s important to make sure that every detail reflects your potential as an applicant. Below, you will find templates and samples for a Financial Analyst resume, as well as tips from professionals on the best way to customize them for an internship application.

As a Financial Analyst at the company name, I helped increase revenue by $2million through more efficient management of resources while keeping costs manageable.

We recommend you to go through our article “how to write a resume“. We assure you will get the best of your knowledge to build a job-winning Financial Analyst Resume or curriculum vitae. In case if you want to know about the types of resume formats used in the current job market. We are happy to give you the full details about the “resume formats” for your next job.

Financial Analyst Resume Writing Guide:

1. The Objective

The key to making a good resume is knowing your objective. The objective should be written as a clear, concise, and measurable statement (for example: “Purchased two office chairs for the lobby desk”, or “Reduced inventory levels by 15%”). It tells the reader what you are expecting out of them seeing your resume. The objective should also link to each of the key skill statements in your resume, which can be found here »

2. The Summary

The mission statement for your resume can be found at the top – after the objective – as a recap of the skills and accomplishments you want to highlight.

- The Experience Section

The experience section goes under your objective and summarizes your skills, competencies, duties, and achievements relevant to that purpose. These sections should be written in a way that enables the reader to understand what you did in the past and tie it into your objective.

4. The Skills Summary

The skills section lists your skills. It should include three to five key solutions, projects, or programs experienced during the course of employment relevant to the objective and summarized in bullets and sub-headings so they are easy to read. These skills can come from any part of your history; however, they must support your objective. Each skill should be described in one or two sentences, and the sub-headings should be set in bold so they stand out from the rest of the text.

5. The Competencies Section

The competencies section is a summary of skills that can also be used to describe your resume. It should be used to describe your personality, which is a factor that can influence the evaluation of an applicant. The summary in this part shows how you relate to other people and what type of work environment you prefer.

Financial Analyst Responsibilities:

- Describe 3-5 month financial forecasts for a company.

- Perform monthly and yearly budget analysis, including all expenses, revenue, and profit margins.

- Explain the breakdown of revenues by account type (e.g., sales, services) and how each will fit into corporate plans for the upcoming months.

- Analyze the financial situation of a company’s competitors to determine those companies’ strengths and weaknesses in relation to any particular market sectors you may be researching or predicting for your client(s).

- Perform a preliminary financial analysis of potential business opportunities for your client (if you’re working in consulting).

- Perform cost-benefit analyses of company products to determine whether or not it makes more sense to continue production/manufacturing (if you’re working in manufacturing).

- Identify ways to make a company more profitable, which may include, but is not limited to: identifying areas where costs can be reduced, identifying new costs that could be added in order to increase revenues, etc.

- Formulate corporate plans for new products, services, factories, or other aspects of a company’s operations.

- Make recommendations regarding sourcing and/or pricing of goods and services.

- Analyze market trends and issue reports that will provide critical information to senior management on how these trends will impact a company’s future plans.

Top 15 Must-have Financial Analyst Skills:

- Investing, both in stocks and bonds.

- Understanding financial statements (stock, bond, mutual fund)

- Understanding options and stocks.

- Cash flow forecasting

- Forecasting of future sales revenue for corporations or divisions of a company.

- Understanding the expenses that companies incur (audit preparation for accountants)

- Reading the balance sheet to see financial condition of the company (gives you an idea about how a company will react to a certain event).

- Financial modeling

- Profitability Management

- Financial policy, control and compliance

- Preparation of Financial Statement

- Knowledge of audit process and procedures

- Financial Statement Analysis

- Financial Statement Preparation

- Public financial reporting (SEC filings, 10K and 10Q)

///

Tips to write a Financial Analyst Resume Summary:

A resume summary is generally one to three sentences long and highlights your skills and experience relevant to the job you are applying for. It should be written in the format of an accomplishment statement: a description of what you accomplished, rather then what your responsibilities were. For example, describe the results that you produced in terms of what you actually did, not just what your job title was.

Concisely summarize all of your qualifications that relate to the job for which you are applying and highlight your career goals.

Tips:

- Organize your resume summary around accomplishments, not responsibilities. This will show you as an individual with a track record for producing results in a particular area, rather than just as a name and title on the bottom of someone else’s job description.

- Include one or two career highlights that demonstrate your abilities and experience. Also include information on relevant education, professional memberships and other achievements that may have enhanced your job application.

- Include contact information for references who can provide further information about you and your work experience.

Tips to write a Financial Analyst Resume Objective:

The objective is an accomplishment statement that highlights your skills and abilities relevant to the job for which you are applying. It should be one paragraph long, and should be written in the format of a career goal: a description of what you plan to do at a future job or career level in order to attain your desired results.

The objective should include the following:

- A statement of your short-term career goals, including the type of job you are seeking (e.g., manager, executive, financial analyst) and a statement of what you hope to accomplish in that position. This should include a description of what skills or knowledge you will use as a qualified professional to achieve the results.

- A statement of your long-term career goals, including the type of job you would like to have in five years and what results you would hope to achieve as a qualified professional.

How to write a Financial Analyst Resume with No experience:

- Write your personal information.

- Include any education information you have.

- Write a Summary of Qualifications.

- Write a paragraph about your core competencies, skills, and abilities that are relevant to the job you’re applying for.

- List any certifications or professional licenses you may have earned that are pertinent to the job you’re applying for. Also list professional associations or organizations of which you are a member, if any.

- List your references and phone numbers for each. (The more personal the better; include every contact.)

- Include a Professional Summary that jumps out at the employer who is reviewing your resume.

- Include a Professional Summary that explains why you want the job and how you will be an asset to the company in achieving its goals. (Make sure it is about 25-50 words and do not list your experience on this section.)

- Include a Skills section that states your job-related skills with demonstrable examples. (This should be about 3-4 paragraphs.)

- Include a Work Experience section that includes all of your job titles with dates, whether you were full time or part time, and give a general description of the duties and responsibilities associated with each position. Be sure to include growth & development experiences.

How to write a Financial Analyst Cover Letter:

A resume cover letter is a good place to tell the company why you are interested in the position they have posted and why you are the best person to fill it. Here are some tips on how to write a good, effective Financial Analyst Resume.

1) Enter information from your resume into the form provided through a header file (use a text editor). This will create a permanent master cover letter that can be customized for each application.

2) Separate out personal information from professional information. If you are a college student, you will likely need to write a cover letter and resume for an internship as well as a resume for any part time jobs you have held. A cover letter that crosses over to other resume templates makes your life easier because it ensures that you will not have to re-write information found on your resume each time you apply for a new job.

3) Make sure that your cover letter is personalized for each company. While a cover letter applies to all resumes, the information within each cover letter should be written specifically to the company for which you are applying. If you are applying to multiple positions at one company, always write a new cover letter for each position.

4) Make sure to include references on your resume cover letter. While this takes more space, references can help recruiters and hiring managers make decisions about you in advance of an interview. They can also give information about your work ethic and personality that is not on your resume.

Key Takeaways:

- Know what makes a good resume when applying for an analyst position.

- Learn how to customize your resume specifically for the job you want.

- Write a cover letter that will distinguish you from all other candidates and get your foot in the door.

- Don’t forget to proofread and spell check.

- Always send a follow up email the next day.

I hope you are ready to create the Financial Analyst Resume that helps you to land your dream job?

Build Your Resume Now!