Exploring the Role of an Investment Banker

As the financial landscape continues to evolve, the role of an Investment Banker remains a key player in shaping economic success globally. This position demands a unique blend of financial acumen and strategic thinking, guiding individuals and organizations towards sound investment decisions. Let’s delve into the multifaceted role of an Investment Banker, exploring the responsibilities, job requirements, and essential skills that define this pivotal role.

What are the Investment Banker Job Requirements?

Embarking on the journey to become an Investment Banker involves meeting a series of stringent requirements. The path requires a solid educational foundation, technical expertise, and a knack for financial analysis. Let’s explore the prerequisites for embracing the role of an Investment Banker:

- A Bachelor’s or Master’s degree in Finance, Business, Economics, or a related field, showcasing a strong foundation in financial principles.

- Profound knowledge of financial markets, investment strategies, and risk management.

- Experience in financial modeling and analysis, demonstrating a track record of analytical skills and attention to detail.

- Strong communication and interpersonal skills, essential for building relationships with clients and stakeholders.

- Leadership and teamwork abilities, honed through experiences and possibly through courses and certifications.

- Proficiency in financial software and tools, such as Excel, Bloomberg, and other industry-standard applications.

- Ability to thrive in a fast-paced and dynamic environment, showcasing adaptability and resilience.

Attaining additional certifications, such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM), can enhance your profile in the competitive financial job market.

What are the Responsibilities of an Investment Banker?

The role of an Investment Banker is a tapestry of varied responsibilities, woven with threads of financial expertise, strategic thinking, and client-centric services. Let’s unravel the core responsibilities that define this role, each thread contributing to the success of clients and the financial institution:

- Conducting in-depth financial analysis to provide clients with investment recommendations and strategies.

- Assisting clients in raising capital through various financial instruments, such as stocks and bonds.

- Advising on mergers and acquisitions, conducting due diligence, and negotiating deals on behalf of clients.

- Creating detailed financial models to assess the potential outcomes of investment decisions.

- Building and maintaining relationships with clients, understanding their financial goals, and tailoring investment solutions accordingly.

- Staying abreast of market trends, economic developments, and regulatory changes to provide informed advice.

- Collaborating with cross-functional teams, including legal and compliance departments, to ensure regulatory compliance.

Each responsibility comes with its own set of challenges and opportunities, shaping you into a financial leader.

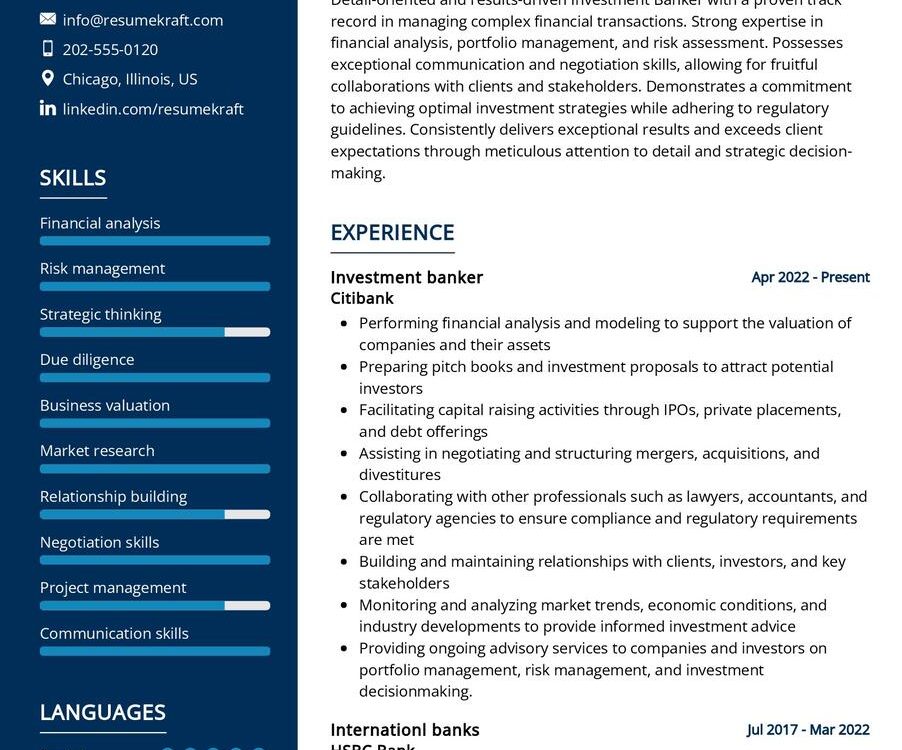

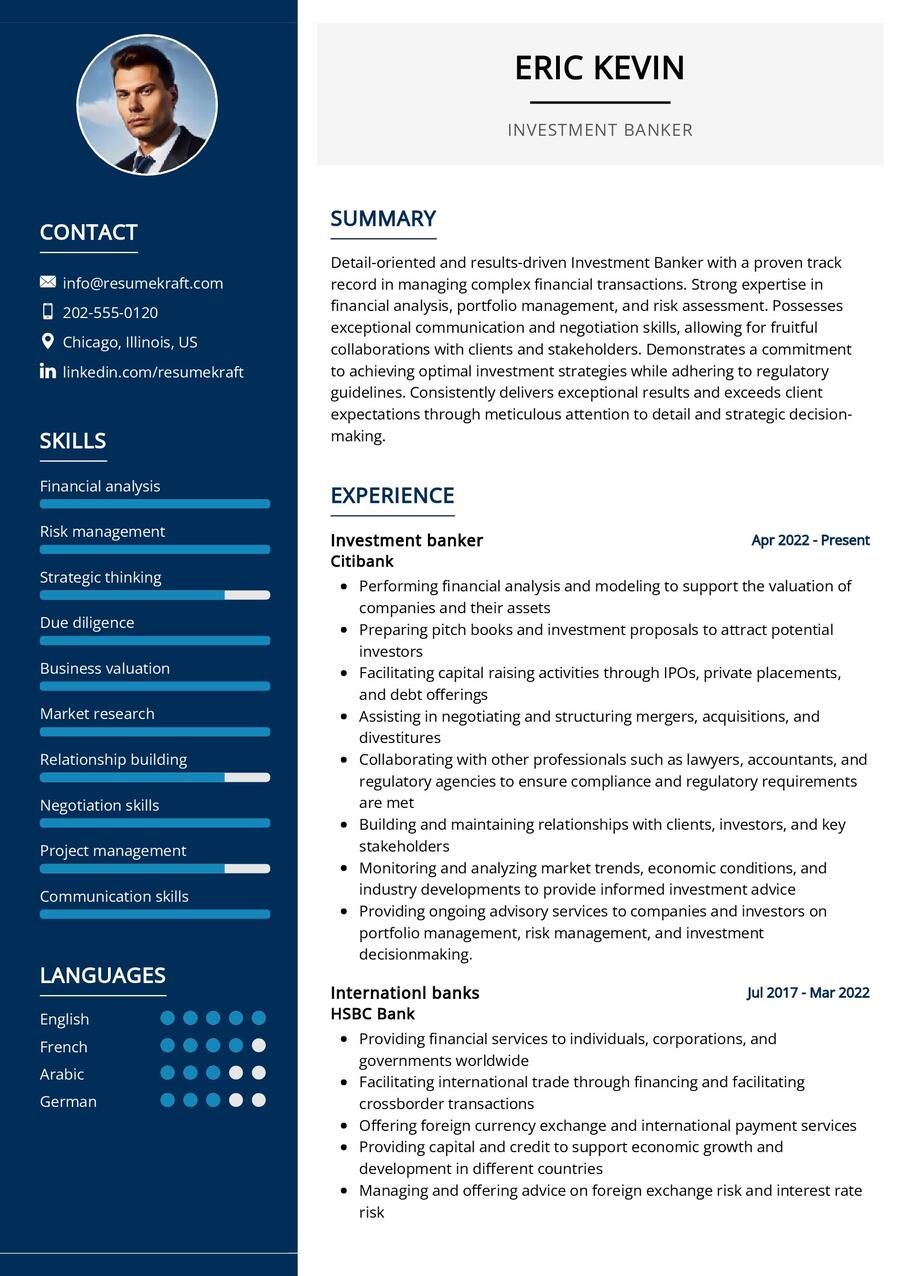

Investment Banker Resume Writing Tips

Crafting a resume that stands out in the competitive financial job market is crucial for aspiring Investment Bankers. Your resume should be a reflection of your expertise, achievements, and commitment to financial excellence. Here are some tips to help you create an impactful resume:

- Highlight your successful financial deals, showcasing instances where your advice led to positive outcomes for clients.

- Detail the breadth of your financial analysis skills, narrating specific instances where your insights made a difference.

- Quantify your achievements, using metrics to demonstrate the impact of your financial recommendations on clients’ portfolios.

- List relevant certifications and training, showcasing your commitment to continuous learning and professional development.

- Customize your resume for the specific role, emphasizing the skills and experiences that align with the job description.

Each tip is a brushstroke, helping you paint a compelling and authentic portrait of your financial expertise.

Investment Banker Resume Summary Examples

Your resume summary serves as the opening act of your career story, setting the stage for what follows. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the financial arena. Here are some examples to inspire you:

- “Results-driven Investment Banker with over 8 years of experience, adept at crafting investment strategies that maximize returns and minimize risks.”

- “Experienced Financial Advisor specializing in mergers and acquisitions, with a proven track record of successfully navigating complex financial landscapes.”

- “Detail-oriented Investment Banker with expertise in financial modeling and analysis, dedicated to helping clients achieve their financial goals.”

Each summary is a window to your career, offering a glimpse of your journey, your strengths, and your vision as an Investment Banker.

Create a Strong Experience Section for Your Investment Banker Resume

Your experience section is the heart of your resume, pulsating with the rich experiences you’ve gathered over the years. It is a space where you narrate your financial journey, highlighting the milestones and the learning. Here are some examples to guide you:

- “Led successful negotiations for a high-profile merger, resulting in a 25% increase in the client’s market value.”

- “Developed and executed comprehensive financial models for diverse clients, resulting in a 15% improvement in investment portfolio performance.”

- “Provided strategic financial advice to clients, resulting in a successful capital raise of $50 million for a key project.”

Each experience is a chapter in your financial book, narrating tales of challenges met, solutions found, and successes achieved.

Sample Education Section for Your Investment Banker Resume

Your educational journey is the foundation upon which your financial career stands. It is a testimony to your knowledge, your expertise, and your commitment to the field. Here’s how you can list your educational milestones:

- Master of Business Administration (MBA) in Finance, XYZ University, a journey of deep learning and specialization, 2015.

- Bachelor of Science in Economics, ABC University, the foundation stone of your financial career, 2012.

- Chartered Financial Analyst (CFA) Certification, a recognition of your financial expertise, 2016.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your financial career.

Investment Banker Skills for Your Resume

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that an Investment Banker should possess:

Soft Skills:

- Financial analysis and modeling, the ability to dissect complex financial data and provide insightful recommendations.

- Effective communication, the skill to convey financial insights and recommendations to clients and stakeholders.

- Negotiation and deal-making, the ability to navigate complex financial transactions and secure favorable outcomes.

- Client relationship management, the art of building and maintaining strong relationships with clients.

- Problem-solving abilities, the knack of finding solutions to financial challenges.

Hard Skills:

- Proficiency in financial software, such as Excel, Bloomberg, and other industry-standard tools.

- In-depth knowledge of financial markets, investment strategies, and risk management.

- Experience in mergers and acquisitions, with a track record of successful deal negotiations.

- Strategic financial planning, the ability to create comprehensive financial models and investment strategies.

- Regulatory compliance, a thorough understanding of financial regulations and compliance requirements.

Each skill is a tool, aiding you in providing exceptional financial advice and leading your clients towards success.

Most Common Mistakes to Avoid When Writing an Investment Banker Resume

As you craft your resume, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream job as an Investment Banker. Here we list down the mistakes often seen in resumes and how to avoid them:

- Avoid using generic terms; instead, tailor your resume to highlight your unique financial achievements and skills.

- Focus on quantifiable achievements rather than listing general job duties, showcasing the tangible impact of your financial expertise.

- Don’t underestimate the power of a well-crafted cover letter; use it as an opportunity to showcase your passion for finance and your understanding of the industry.

- Ensure your resume is accessible to a wide audience by avoiding excessive financial jargon that may alienate non-expert readers.

- Proofread thoroughly to maintain a polished and professional image, avoiding typos and grammatical errors that could undermine your credibility.

Each mistake is a potential stumbling block, so it’s crucial to navigate around them to craft a resume that is both authentic and compelling.

Key Takeaways for Your Investment Banker Resume

As we conclude this comprehensive guide, let’s recap the key points to keep in mind while crafting your Investment Banker resume:

- Highlight your successful financial deals, showcasing instances where your advice led to positive outcomes for clients.

- Emphasize your financial analysis skills, detailing specific instances where your insights made a significant difference.

- Quantify your achievements, using metrics to demonstrate the impact of your financial recommendations on clients’ portfolios.

- Include a section on continuous learning, showcasing relevant certifications and training to demonstrate your commitment to professional development.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, <a href="