What is the Role of a Personal Banker?

The role of a Personal Banker is a critical one in the world of finance. Personal Bankers serve as the primary point of contact for customers seeking financial services and guidance. This position blends financial expertise with strong interpersonal skills, making it essential for anyone aspiring to excel in the banking industry. Let’s delve deeper into the multifaceted role of a Personal Banker, a profession that requires a deep understanding of financial products and the ability to build strong customer relationships.

A Personal Banker is responsible for providing a wide range of banking services to customers, from opening accounts and processing transactions to offering financial advice and guidance. They play a pivotal role in helping individuals and small businesses manage their finances effectively. Personal Bankers are not just transaction processors; they are financial partners who work closely with customers to achieve their financial goals.

What are the Personal Banker Job Requirements?

Becoming a successful Personal Banker requires meeting specific job requirements and developing essential skills. Let’s explore the prerequisites that one needs to fulfill to embrace the role of a Personal Banker:

- A Bachelor’s degree in Finance, Economics, Business Administration, or a related field, providing a strong foundation in financial concepts.

- Profound knowledge of banking products and services, including savings accounts, loans, credit cards, and investment options.

- Experience in customer service, with a focus on building and maintaining positive relationships with clients.

- Excellent communication and interpersonal skills, as Personal Bankers need to explain complex financial information in a clear and understandable manner.

- Attention to detail, a crucial trait when processing financial transactions and ensuring accuracy in all banking activities.

- Strong problem-solving abilities, as Personal Bankers often assist clients in finding the best financial solutions for their unique situations.

Additionally, obtaining certifications related to financial planning and banking can enhance your qualifications and credibility in the field.

What are the Responsibilities of a Personal Banker?

The role of a Personal Banker involves a diverse range of responsibilities, all aimed at helping clients achieve their financial objectives. Let’s unravel the core responsibilities that define this role:

- Assisting customers in opening and managing various types of bank accounts, including checking, savings, and certificates of deposit.

- Providing information on different financial products and services, helping clients make informed decisions about their finances.

- Processing financial transactions such as deposits, withdrawals, and loan payments accurately and efficiently.

- Offering financial advice and guidance to clients, including budgeting, saving, and investment strategies.

- Evaluating loan applications and working with clients to complete the necessary paperwork for loan approvals.

- Identifying opportunities to cross-sell banking products and services to clients based on their financial needs and goals.

- Resolving customer inquiries, concerns, and issues promptly and professionally.

- Staying updated on banking regulations and industry trends to ensure compliance and provide the best possible service to clients.

Each responsibility is a building block in the foundation of financial success for both the clients and the Personal Banker.

Personal Banker Resume Writing Tips

Your resume is your gateway to securing a Personal Banker position, and it should reflect your expertise and commitment to helping clients achieve financial stability. Here are some tips to craft a compelling Personal Banker resume:

- Highlight your customer service experience, emphasizing instances where you’ve successfully assisted clients in achieving their financial goals.

- Detail any special projects or initiatives you’ve led within the banking industry, showcasing your leadership and innovation.

- Include quantifiable achievements, such as the number of new accounts opened or the percentage increase in loan approvals during your tenure.

- List relevant certifications or training programs related to banking and financial planning.

- Tailor your resume for each job application, aligning your skills and experiences with the specific requirements of the position.

Your resume should be a reflection of your dedication to helping individuals and businesses thrive financially.

Personal Banker Resume Summary Examples

Your resume summary is your opportunity to make a strong first impression on potential employers. It should concisely convey your qualifications and your commitment to excellence as a Personal Banker. Here are some examples to inspire you:

- “Dedicated Personal Banker with a track record of building lasting client relationships and achieving financial success. Committed to helping individuals and businesses navigate their financial journeys.”

- “Experienced Personal Banker skilled in providing comprehensive financial solutions. A trusted advisor with a passion for helping clients achieve their financial goals.”

- “Customer-focused Personal Banker with a strong background in banking products and services. Committed to delivering top-notch financial guidance and support.”

Your resume summary should capture your essence as a Personal Banker, emphasizing your dedication to client success.

Create a Strong Experience Section for Your Personal Banker Resume

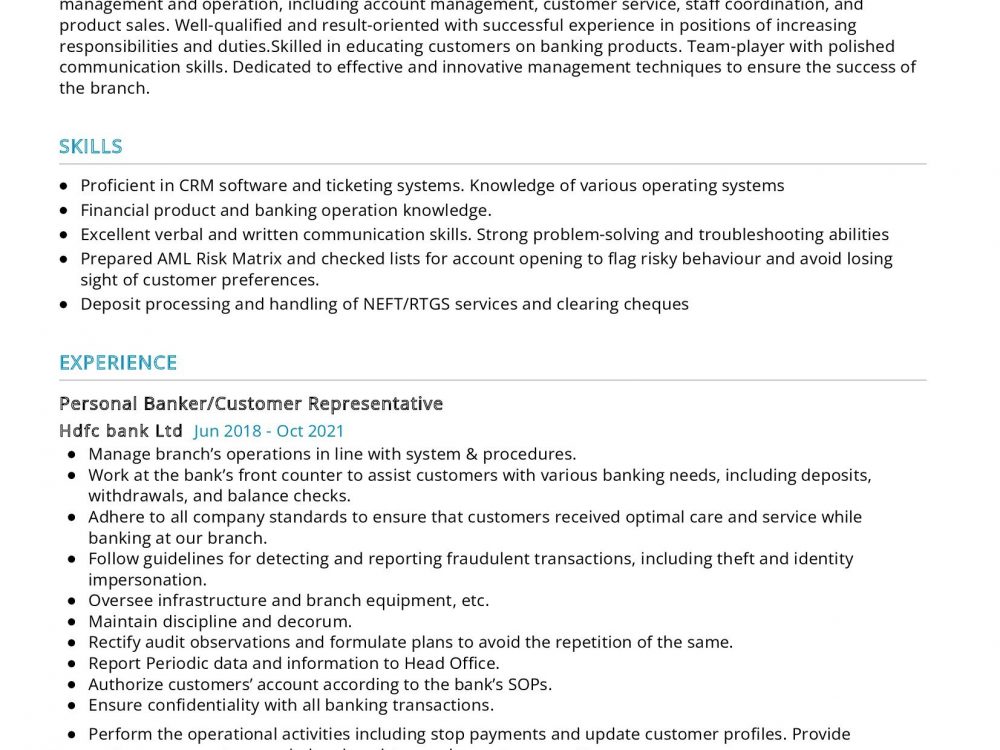

Your experience section is the core of your resume, where you narrate your career journey in the banking industry. Here are some examples to guide you in creating a compelling experience section:

- “Managed a portfolio of over 200 client accounts, increasing total deposits by 15% through effective financial advising and cross-selling of banking products.”

- “Led a team of Personal Bankers in providing exceptional customer service, resulting in a 98% client satisfaction rate and a 20% increase in branch revenue.”

- “Collaborated with clients to create personalized financial plans, helping them achieve their financial goals, including debt reduction and home ownership.”

Each experience you share should illustrate your impact and contributions to the financial well-being of your clients and the success of your bank.

Sample Education Section for Your Personal Banker Resume

Your educational background is an essential aspect of your qualifications as a Personal Banker. Here’s how you can list your educational achievements:

- Bachelor of Science in Finance, XYZ University, a comprehensive education in financial principles and practices, 2016.

- Certified Financial Planner (CFP) Certification, demonstrating expertise in financial planning and wealth management, 2017.

- Advanced Bank Management Course, ABC Institute, enhancing skills in banking operations and risk management, 2018.

Your education is a testament to your commitment to mastering the financial field.

Personal Banker Skills for Your Resume

Your skill set as a Personal Banker is a toolbox of abilities that enable you to provide exceptional financial services to your clients. Let’s list down the essential skills that a Personal Banker should possess:

Soft Skills:

- Customer service excellence, the ability to build rapport and trust with clients.

- Communication skills, including active listening and effective verbal and written communication.

- Problem-solving abilities, the knack for finding financial solutions tailored to each client’s needs.

- Attention to detail, ensuring accuracy in financial transactions and documentation.

- Adaptability, the capacity to adjust to changing market conditions and client needs.

Hard Skills:

- Financial product knowledge, including familiarity with savings accounts, loans, credit cards, and investment options.

- Banking software proficiency, the ability to use financial software for transactions and client management.

- Regulatory compliance, understanding and adherence to banking regulations and industry standards.

- Financial analysis, the skill to assess a client’s financial situation and recommend suitable products and services.

- Sales and cross-selling techniques, the ability to identify opportunities and recommend additional banking products.

Each skill in your toolbox contributes to your effectiveness as a Personal Banker.

Most Common Mistakes to Avoid When Writing a Personal Banker Resume

While crafting your resume, it’s essential to avoid common mistakes that can hinder your chances of landing your dream Personal Banker job. Here are some pitfalls to steer clear of:

- Using a generic resume for all applications, which fails to highlight your specific qualifications and experiences relevant to the position.

- Focusing solely on job duties rather than showcasing your achievements and contributions to your previous employers and clients.

- Neglecting to include a well-crafted cover letter, a missed opportunity to personalize your application and express your genuine interest in the position.

- Overloading your resume with jargon or technical terms that may not be familiar to all readers, potentially alienating some employers.

- Failing to proofread your resume for errors, which can leave a negative impression of your attention to detail.

Avoiding these mistakes will help you create a resume that effectively communicates your value as a Personal Banker.

Key Takeaways for Your Personal Banker Resume

As you wrap up your resume-building journey, remember these key points to create a standout application:

- Highlight your commitment to client success and your ability to provide personalized financial guidance.

- Emphasize your financial knowledge and skills, showcasing your expertise in banking products and services.

- Detail your significant contributions within the banking industry, such as increasing client deposits or improving branch revenue.

- Include relevant certifications and training to demonstrate your dedication to ongoing professional development.

With these insights and tips, you’re well-prepared to craft a Personal Banker resume that stands out in the competitive world of banking.

Ready to take the next step in your banking career? Utilize our AI Resume Builder to create an impressive resume that showcases your qualifications and lands you that dream Personal Banker position. Your financial journey awaits!