Exploring the Role of a Risk Monitoring Accountant

In today’s dynamic financial landscape, the position of a Risk Monitoring Accountant plays a crucial role in helping organizations navigate the complexities of financial risk management. This role demands a unique blend of financial expertise, analytical prowess, and a keen eye for detail. In this comprehensive guide, we will delve into the multifaceted world of a Risk Monitoring Accountant, understanding their responsibilities, qualifications, and the skills required to excel in this role.

Key Responsibilities of a Risk Monitoring Accountant

The role of a Risk Monitoring Accountant revolves around safeguarding an organization’s financial stability by identifying, assessing, and mitigating risks. Here are some key responsibilities that define this role:

- Risk Assessment: Conduct thorough risk assessments by analyzing financial data and market trends to identify potential risks that could impact the organization’s financial health.

- Compliance: Ensure compliance with financial regulations and internal policies, making sure that the organization operates within legal and ethical boundaries.

- Financial Analysis: Perform in-depth financial analysis to evaluate the financial health of the organization and provide insights to management for informed decision-making.

- Reporting: Generate detailed reports on risk exposure, financial performance, and recommendations for risk mitigation strategies.

- Risk Mitigation: Develop and implement risk mitigation strategies, including hedging and insurance, to protect the organization from financial losses.

- Communication: Effectively communicate risk-related information to key stakeholders, including executives, to facilitate risk management decisions.

Each of these responsibilities demands a high level of expertise and precision, making the role of a Risk Monitoring Accountant integral to an organization’s financial stability.

Qualifications and Educational Background

Becoming a proficient Risk Monitoring Accountant requires meeting specific qualifications and obtaining the necessary education. Here are the key qualifications and educational background typically sought after:

- Bachelor’s Degree: A bachelor’s degree in Accounting, Finance, or a related field is often the minimum educational requirement for this role.

- Professional Certification: Many Risk Monitoring Accountants pursue certifications such as Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) to enhance their qualifications.

- Experience: Gaining experience in accounting or financial analysis roles is crucial. Many Risk Monitoring Accountants start as junior accountants or financial analysts before progressing to this role.

- Analytical Skills: Strong analytical skills are a must, as Risk Monitoring Accountants need to dissect complex financial data and identify potential risks.

- Attention to Detail: Being detail-oriented is essential to spot potential risks and ensure financial accuracy.

- Communication: Effective communication skills are necessary for presenting findings and recommendations to management and stakeholders.

Continuing education and staying updated with changes in financial regulations are also important for staying relevant in this field.

Skills That Set Apart a Risk Monitoring Accountant

Being successful in the role of a Risk Monitoring Accountant requires a unique set of skills. Here are some of the key skills that set apart the best in this profession:

1. Data Analysis: The ability to analyze complex financial data and identify patterns and trends is crucial for effective risk assessment.

2. Risk Management: Proficiency in risk management strategies and tools, including financial derivatives and insurance, is essential to protect the organization from potential financial losses.

3. Financial Modeling: Creating accurate financial models to simulate various scenarios and assess their impact on the organization’s financial health.

4. Problem-Solving: The capacity to identify problems and develop creative solutions to mitigate risks and improve financial outcomes.

5. IT Proficiency: Familiarity with financial software and data analysis tools is essential in today’s technology-driven financial landscape.

6. Communication: The ability to convey complex financial information in a clear and understandable manner is crucial for effective communication with stakeholders.

7. Attention to Detail: Ensuring accuracy in financial reporting and risk assessments is a hallmark of a proficient Risk Monitoring Accountant.

These skills, combined with a deep understanding of financial markets and regulations, make a Risk Monitoring Accountant an invaluable asset to any organization.

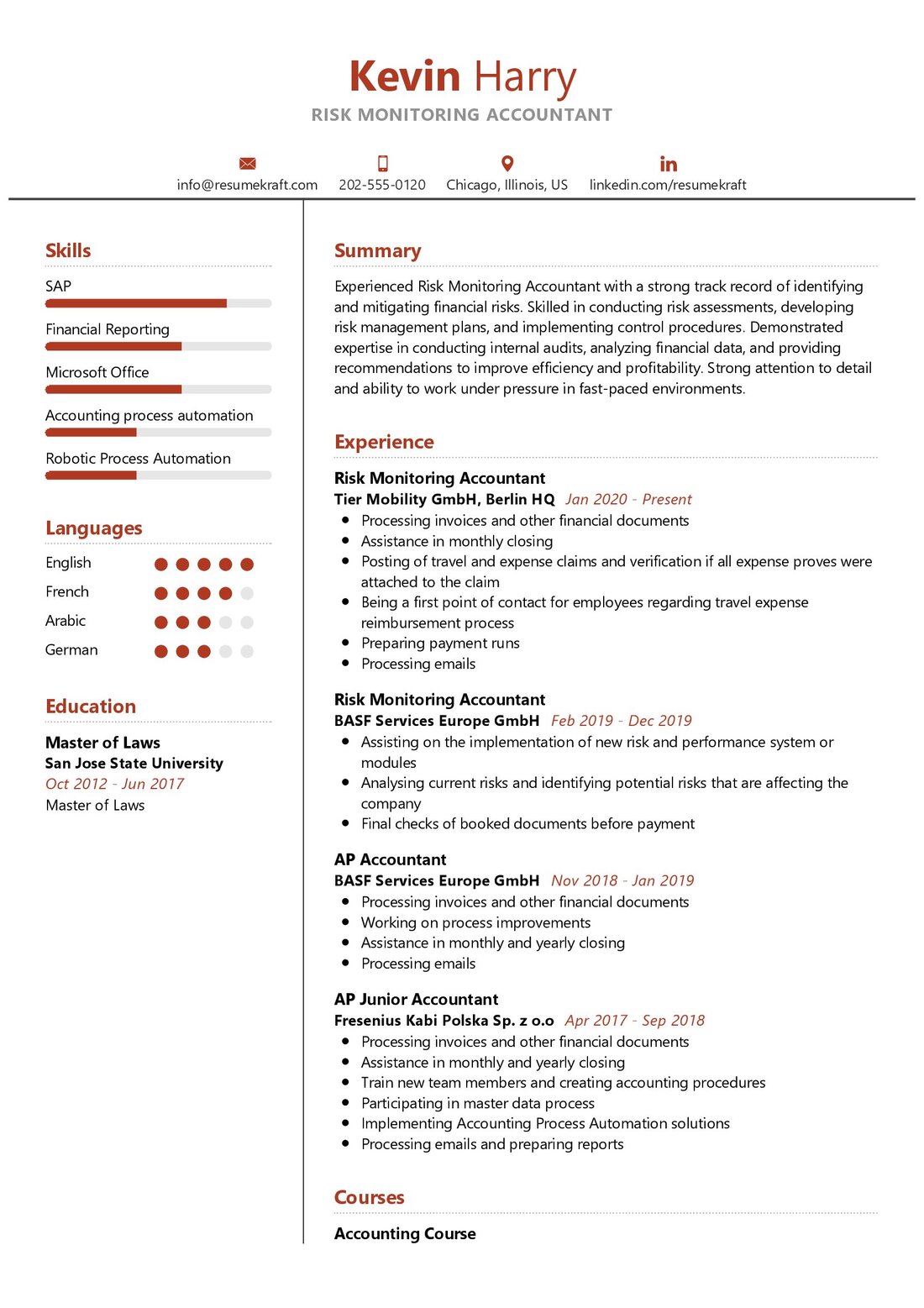

Crafting a Standout Risk Monitoring Accountant Resume

Your resume is your ticket to landing a role as a Risk Monitoring Accountant. Here are some tips to create a compelling resume that highlights your qualifications and skills:

- Highlight Relevant Experience: Emphasize your experience in financial analysis, risk management, and compliance to showcase your expertise.

- Showcase Achievements: Use quantifiable achievements to demonstrate your impact, such as reducing financial risks or improving compliance.

- Include Certifications: List any relevant certifications, such as CPA or CFA, to bolster your qualifications.

- Use Action Words: Begin bullet points with action verbs like “analyzed,” “managed,” or “implemented” to make your resume more dynamic.

- Customize for the Job: Tailor your resume for each job application, highlighting skills and experiences that align with the specific role.

Your resume is your first impression, so make it count by showcasing your qualifications effectively.

Conclusion

The role of a Risk Monitoring Accountant is pivotal in safeguarding an organization’s financial stability. With a strong educational background, relevant experience, and a unique set of skills, you can excel in this profession and contribute to the financial success of your organization. If you’re ready to take the next step in your career as a Risk Monitoring Accountant, start by crafting an impressive resume that highlights your qualifications and skills. Remember, your resume is your key to opening doors to exciting career opportunities in the world of finance.

Ready to take the next step in your career as a Risk Monitoring Accountant? Craft an impressive resume that highlights your qualifications and skills. Utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Risk Monitoring Accountant job interview.