What is the Role of an Account Consultant?

In the dynamic world of finance and business, the role of an Account Consultant is instrumental in ensuring the financial well-being and growth of organizations. With a keen eye for detail and a comprehensive understanding of financial principles, an Account Consultant plays a pivotal role in managing and optimizing financial operations. Let’s delve deeper into the multifaceted role of an Account Consultant, understanding the nuances of their responsibilities and the impact they make within organizations.

What are the Account Consultant Job Requirements?

Stepping into the shoes of an Account Consultant demands a specific set of skills and qualifications. It requires a blend of financial expertise, analytical proficiency, and communication skills. Here’s an overview of the prerequisites necessary to excel in the role of an Account Consultant:

- A Bachelor’s or Master’s degree in Accounting, Finance, or a related field, providing a strong foundation in financial principles and practices.

- Proficient knowledge of accounting software and tools, enabling efficient management of financial data and transactions.

- Demonstrable experience in financial analysis and reporting, showcasing the ability to interpret complex financial data.

- Strong communication and interpersonal skills, essential for building relationships with clients and effectively conveying financial insights.

- Attention to detail and strong problem-solving abilities, necessary for identifying discrepancies and proposing effective solutions.

- Ability to work under pressure and meet strict deadlines, reflecting the demands of the fast-paced financial industry.

Acquiring relevant certifications such as Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) can significantly enhance your profile and credibility in the competitive job market.

What are the Responsibilities of an Account Consultant?

An Account Consultant shoulders a range of responsibilities crucial for the financial well-being of a company. Let’s explore the key duties that define the role of an Account Consultant, showcasing their contribution to the financial stability and growth of organizations:

- Managing and maintaining financial records and documentation, ensuring accuracy and compliance with regulatory standards.

- Conducting financial analysis and generating reports, providing insights that aid in informed decision-making for the management team.

- Assisting clients with financial planning and budget management, offering tailored strategies to maximize financial resources.

- Providing guidance on tax planning and ensuring compliance with relevant tax laws and regulations.

- Collaborating with cross-functional teams to streamline financial processes and optimize financial performance.

- Offering financial advice and recommendations to clients, guiding them in making sound financial decisions aligned with their business goals.

- Staying updated with the latest financial trends and regulatory changes, adapting strategies to ensure adherence to best practices.

Each responsibility highlights the critical role of an Account Consultant in maintaining financial stability and fostering sustainable growth within organizations.

Account Consultant CV Writing Tips

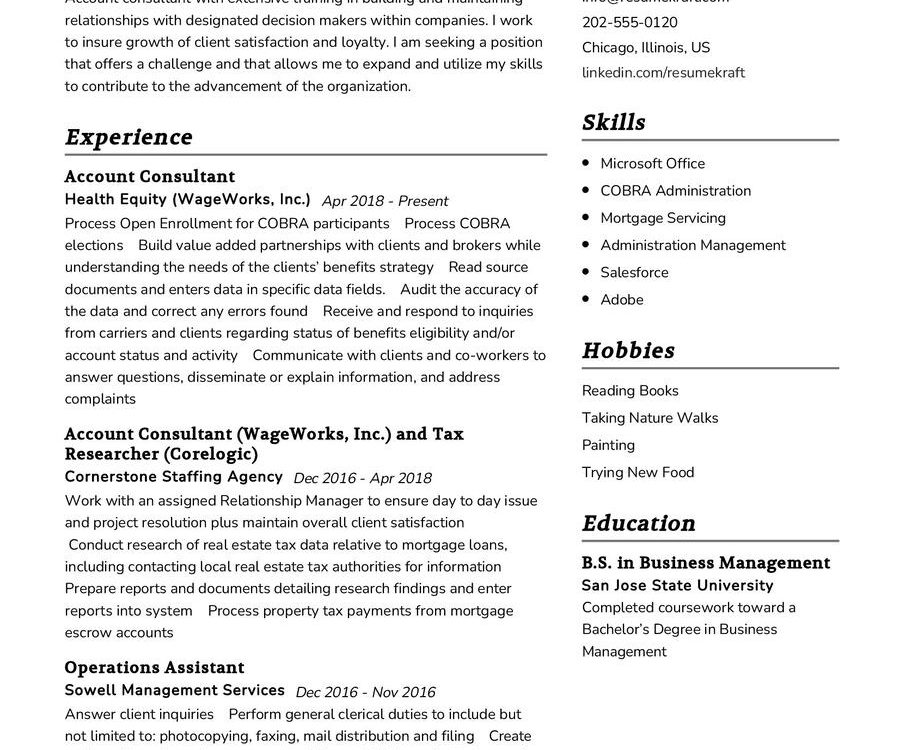

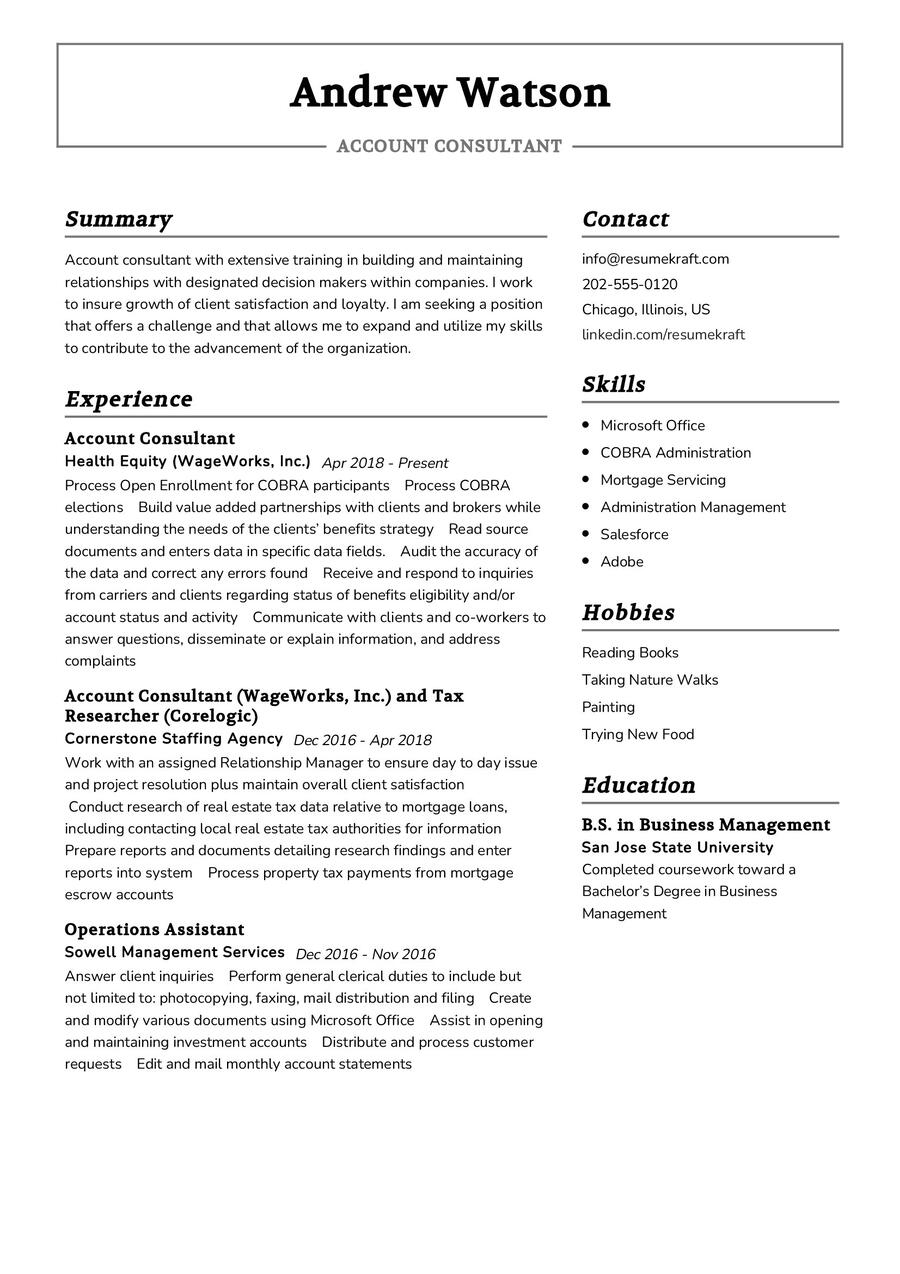

Crafting a compelling Account Consultant CV requires highlighting your financial acumen and your ability to drive financial success for your clients or organization. Here are some tips to create a CV that showcases your expertise effectively:

- Emphasize your experience in managing financial operations and providing strategic financial advice to clients or stakeholders.

- Include specific examples of successful financial projects or initiatives you have led, highlighting the impact on the organization’s financial health.

- Showcase your proficiency with relevant financial software and tools, demonstrating your ability to handle complex financial data.

- Highlight your communication skills and ability to build strong professional relationships, emphasizing your capacity to work effectively with clients and team members.

- Customize your CV to reflect the specific requirements of the Account Consultant role, aligning your skills and experiences with the job description.

Each tip is aimed at creating a CV that effectively communicates your financial expertise and your potential to drive financial success.

Account Consultant CV Summary Examples

Your CV summary serves as a snapshot of your professional journey, highlighting your key skills and experiences as an Account Consultant. Here are some examples to inspire your CV summary:

- “Results-driven Account Consultant with 8 years of experience in providing strategic financial guidance, adept at optimizing financial processes and driving business growth.”

- “Experienced Account Consultant with a proven track record in implementing effective financial strategies, skilled in building strong client relationships and delivering sustainable financial solutions.”

- “Dedicated Account Consultant with a comprehensive understanding of financial management, equipped with strong analytical skills and a passion for driving financial success.”

Each summary presents a glimpse of your expertise and your potential to make a significant impact as an Account Consultant.

Create a Strong Experience Section for Your Account Consultant CV

Your experience section is an opportunity to showcase your contributions and achievements in previous roles, emphasizing your role in driving financial success. Here are some examples to guide you in creating a strong experience section for your Account Consultant CV:

- “Led financial analysis projects, contributing to a 15% increase in overall revenue for the company over two fiscal years.”

- “Developed and implemented financial planning strategies for clients, resulting in a 20% reduction in unnecessary expenses and improved financial stability.”

- “Collaborated with cross-functional teams to streamline financial processes, leading to a 30% improvement in operational efficiency and cost-effectiveness.”

Each experience example highlights your role in driving financial success and contributing to the growth and stability of the organization.

Sample Education Section for Your Account Consultant CV

Your educational background demonstrates your knowledge and expertise in financial principles and practices. Here’s how you can present your education in your Account Consultant CV:

- Master of Business Administration in Finance, XYZ University, a comprehensive program that equipped me with advanced financial management skills, 2017.

- Bachelor of Science in Accounting, ABC University, a foundational degree that laid the groundwork for my understanding of financial principles, 2013.

- Certified Public Accountant (CPA) certification, a testament to my proficiency in handling complex financial matters and ensuring compliance, 2018.

Each educational qualification represents a milestone in your journey toward becoming an accomplished Account Consultant.

Account Consultant Skills for Your CV

Your skill set as an Account Consultant reflects your ability to drive financial success and ensure the stability of your clients’ or organization’s finances. Let’s explore the essential skills that an Account Consultant should possess:

Soft Skills:

- Financial analysis and reporting, the ability to interpret complex financial data and provide strategic insights.

- Communication and interpersonal skills, essential for building strong relationships with clients and stakeholders.

- Strategic financial planning, the capacity to develop tailored financial strategies that align with business objectives.

- Attention to detail and accuracy, crucial for maintaining precise financial records and ensuring compliance.

- Problem-solving abilities, necessary for identifying financial discrepancies and proposing effective solutions.

Hard Skills:

- Proficiency in accounting software, a skill that aids in managing and organizing financial data efficiently.

- Knowledge of tax regulations, essential for providing guidance on tax planning and ensuring compliance.

- Financial forecasting, a capability that enables you to predict financial trends and make informed decisions.

- Budget management, the ability to oversee and optimize financial resources effectively.

- Risk assessment and management, a skill necessary for identifying potential financial risks and developing mitigation strategies.

Each skill represents a key asset that contributes to your success as an Account Consultant, enabling you to navigate complex financial landscapes effectively.

Most Common Mistakes to Avoid When Writing an Account Consultant CV

When creating your Account Consultant CV, it’s crucial to steer clear of common pitfalls that can diminish your chances of landing your dream job. Here are some mistakes to avoid:

- Using generic language and clichés that fail to highlight your unique skills and experiences as an Account Consultant.

- Overlooking specific achievements and impactful projects, resulting in a CV that lacks depth and fails to showcase your contributions.

- Neglecting to tailor your CV to the specific requirements of the Account Consultant role, potentially missing out on opportunities to highlight your suitability for the position.

- Neglecting to proofread your CV, leading to errors and inconsistencies that can create a negative impression on potential employers.

- Failing to provide references or endorsements from previous clients or employers, missing the opportunity to reinforce your credibility and expertise.

Avoiding these mistakes can help you create a compelling and impactful CV that effectively highlights your strengths and capabilities as an Account Consultant.

Key Insights for Your Account Consultant CV

As we conclude this comprehensive guide, it’s essential to remember the key insights that can help you craft a compelling and effective Account Consultant CV:

- Highlight your expertise in financial analysis and strategic financial planning, showcasing your ability to drive financial success for your clients or organization.

- Showcase your proficiency with relevant financial tools and software, emphasizing your capacity to handle complex financial data and processes efficiently.

- Emphasize your role in leading impactful financial projects and initiatives, highlighting your contributions to the growth and stability of the organization.

- Include a section on continuous learning, showcasing any relevant certifications or courses you have undertaken to enhance your financial expertise and stay updated with industry best practices.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Account Consultant job interview questions.