Understanding the Role of a Corporate Controller

In the dynamic landscape of corporate finance, the position of a Corporate Controller plays a pivotal role in steering the financial ship of an organization. This article delves into the multifaceted responsibilities, required qualifications, and key skills that define the role of a Corporate Controller. As a linchpin between financial strategy and operational execution, the Corporate Controller is tasked with ensuring the financial health and compliance of the organization.

Qualifications and Educational Background for a Corporate Controller

Becoming a Corporate Controller is a journey that demands a solid educational foundation and a wealth of experience. Here are the key qualifications that pave the way for a successful career in this role:

- A Bachelor’s or Master’s degree in Accounting, Finance, or a related field, providing a strong foundation in financial principles.

- Certification as a Certified Public Accountant (CPA) is often a prerequisite, showcasing a commitment to the highest standards of professional conduct.

- Extensive experience in progressively responsible financial leadership roles, demonstrating a deep understanding of financial management.

- Knowledge of regulatory requirements and accounting standards, ensuring compliance and accurate financial reporting.

- Strong analytical and problem-solving skills, honed through years of navigating complex financial scenarios.

- Effective communication and leadership skills, vital for collaborating with cross-functional teams and presenting financial information to stakeholders.

Acquiring additional certifications, such as Certified Management Accountant (CMA) or Chartered Financial Analyst (CFA), can further enhance your profile in the competitive corporate landscape.

Responsibilities of a Corporate Controller

The role of a Corporate Controller is a delicate balance of financial stewardship, compliance, and strategic decision-making. Here are the core responsibilities that define this role:

- Financial Reporting and Compliance: Overseeing the preparation of accurate and timely financial statements, ensuring compliance with accounting principles and regulatory requirements.

- Budgeting and Forecasting: Collaborating with department heads to develop budgets, analyzing variances, and providing strategic insights for financial planning.

- Internal Controls: Establishing and maintaining effective internal controls to safeguard the organization’s assets and ensure the accuracy of financial records.

- Team Leadership: Building and leading a high-performing finance team, fostering a culture of accountability, and providing mentorship for professional development.

- Audit Management: Coordinating external audits, liaising with auditors, and implementing recommendations to strengthen financial controls.

- Strategic Financial Planning: Contributing to the development and execution of the organization’s financial strategy, aligning financial goals with overall business objectives.

Each responsibility is a thread in the intricate tapestry of financial management, showcasing the diverse skills required for success in this role.

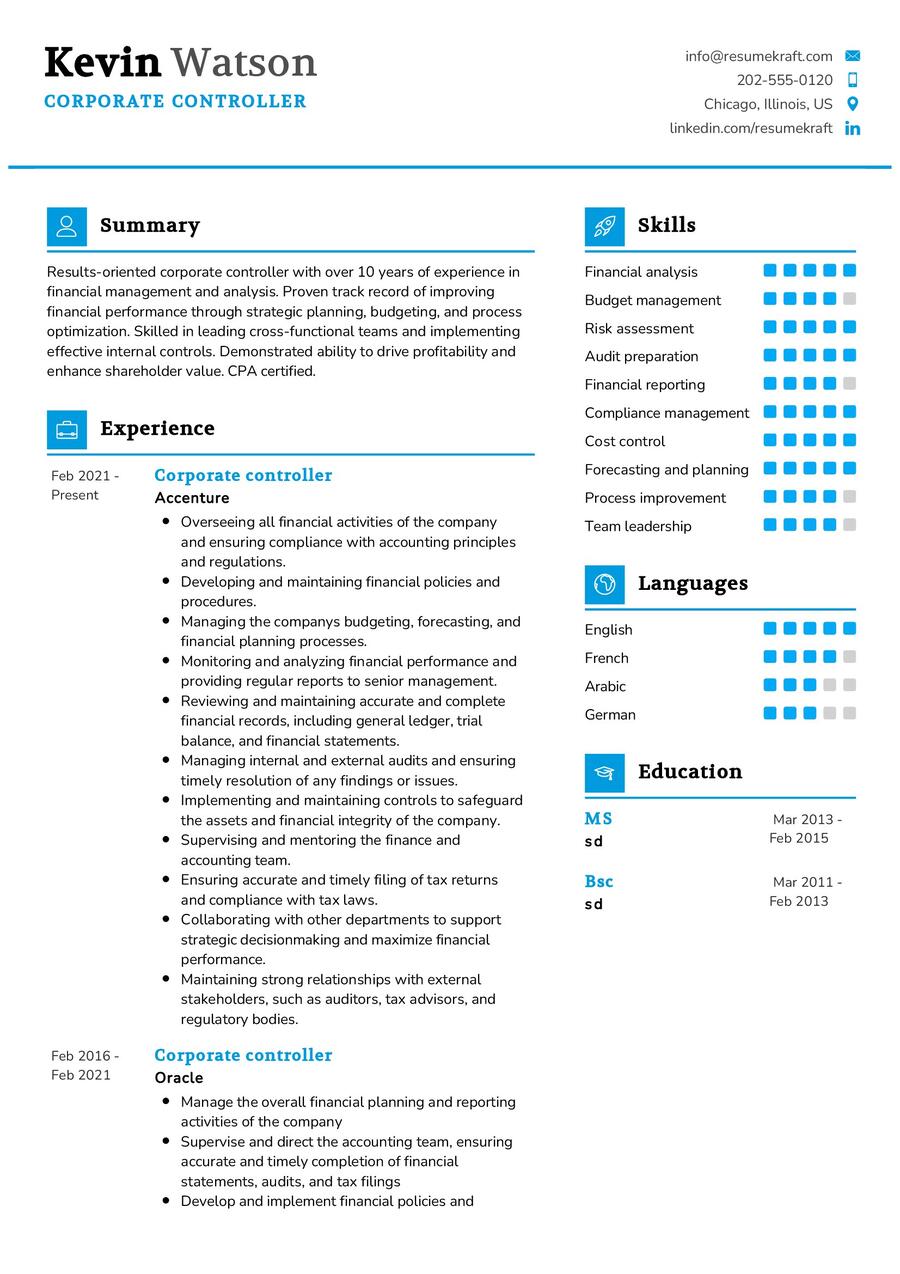

Crafting a Powerful Corporate Controller Resume

Your resume is the gateway to your career story, and as a Corporate Controller, it should reflect your financial acumen and leadership prowess. Here are some tips to create a compelling resume:

- Emphasize Achievements: Highlight specific achievements, such as successful financial restructuring or implementation of cost-saving initiatives, to showcase your impact.

- Showcase Leadership: Detail instances where you’ve led financial teams, demonstrating your ability to inspire and guide others toward common goals.

- Quantify Results: Use metrics to quantify your contributions, whether it’s reducing financial discrepancies, improving reporting accuracy, or optimizing budget processes.

- Highlight Technical Skills: List relevant technical skills, including proficiency in financial software, ERP systems, and advanced Excel capabilities.

- Tailor Your Resume: Customize your resume for each application, aligning your skills and experiences with the specific requirements of the position.

Remember, your resume is a reflection of your journey, showcasing not just what you’ve done but how you’ve made a difference in the financial landscape.

Corporate Controller Resume Summary Examples

Your resume summary sets the tone for your application, providing a snapshot of your career. Here are some examples to inspire you:

- “Dedicated Corporate Controller with over a decade of experience in financial leadership, known for implementing robust internal controls and driving cost efficiencies.”

- “Results-oriented CPA and seasoned financial strategist, adept at guiding organizations through complex financial landscapes and ensuring regulatory compliance.”

- “Experienced Corporate Controller with a track record of optimizing financial processes, leading teams to achieve financial goals, and contributing to strategic decision-making.”

Your resume summary is your opportunity to make a strong first impression, so make it impactful and tailored to your unique strengths.

Building the Experience Section of Your Corporate Controller Resume

Your experience section is the narrative of your career, detailing the chapters that have shaped your financial expertise. Here are examples to guide you in constructing this vital section:

- “Led the financial transformation initiative, resulting in a 15% reduction in operational costs and a streamlined budgeting process.”

- “Managed the successful implementation of a new ERP system, enhancing the efficiency and accuracy of financial reporting.”

- “Guided the finance team through a complex regulatory audit, achieving a clean audit report and establishing best practices for future compliance.”

Each experience is a testament to your ability to navigate challenges, implement solutions, and contribute to the financial success of the organization.

Educational Background for a Corporate Controller Resume

Your educational journey forms the foundation of your financial expertise. Here’s how you can showcase your academic achievements:

- Master of Business Administration in Finance, XYZ University, a comprehensive program providing a strategic perspective on financial management, 2015.

- Bachelor of Science in Accounting, ABC University, the cornerstone of your financial acumen, 2012.

- Certified Public Accountant (CPA), a testament to your commitment to the highest standards of professional conduct, 2014.

Your educational qualifications are a testament to your commitment to continuous learning and your expertise in the field of finance.

Key Skills for a Corporate Controller

Your skill set is your toolkit, and as a Corporate Controller, it should encompass a range of financial and leadership abilities. Here are the essential skills for success in this role:

Soft Skills:

- Leadership and Team Management: Guiding and inspiring financial teams to achieve organizational goals.

- Communication: Effectively conveying complex financial information to diverse stakeholders.

- Strategic Thinking: Contributing to the development and execution of the organization’s financial strategy.

- Problem-Solving: Navigating complex financial challenges and implementing effective solutions.

- Adaptability: Flexibility in responding to changing financial landscapes and business priorities.

Hard Skills:

- Financial Analysis: Analyzing financial data to provide insights for strategic decision-making.

- Internal Controls: Establishing and monitoring effective internal controls to ensure financial accuracy.

- Budgeting and Forecasting: Developing and overseeing budgeting processes for accurate financial planning.

- ERP Systems: Proficiency in utilizing Enterprise Resource Planning systems for streamlined financial operations.

- Regulatory Compliance: Ensuring adherence to accounting standards and regulatory requirements.

Each skill is a valuable asset, contributing to your ability to navigate the complexities of corporate finance.

Common Mistakes to Avoid When Writing a Corporate Controller Resume

As you craft your resume, steer clear of common pitfalls that can detract from your professional image. Here are some mistakes to avoid:

- Generic Approach: Tailor your resume for each application to highlight your unique fit for the specific role.

- Lack of Achievements: Don’t just list job duties; showcase specific achievements and the impact you’ve made in previous roles.

- Ignoring the Cover Letter: Use the cover letter as an opportunity to narrate your story and connect with potential employers.

- Technical Jargon Overload: Balance technical language with clear explanations to ensure your value is easily understood.

- Proofreading Oversight: A polished resume reflects attention to detail, so proofread to eliminate errors and enhance professionalism.

Avoiding these mistakes ensures that your resume stands out as a true representation of your capabilities and accomplishments.

Key Takeaways for Your Corporate Controller Resume

As you conclude your resume crafting journey, remember these key takeaways:

- Highlight your financial achievements and leadership milestones to showcase your impact.

- Emphasize your technical proficiency and expertise in financial management tools.

- Detail the strategic initiatives you’ve spearheaded, illustrating your visionary approach to financial stewardship.

- Include a section on continuous learning, showcasing relevant certifications and ongoing professional development.

With these insights and tips, you are well-equipped to create a standout resume that tells the story of your financial expertise and leadership prowess. Best of luck in your career journey!

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Corporate Controller job interview questions.