Unlocking Success: The Role of a Financial Analyst

In the dynamic world of finance, the position of a Financial Analyst plays a crucial role in steering the financial success of organizations. A harmonious blend of analytical prowess and strategic thinking, a Financial Analyst is the backbone of informed decision-making. Let’s delve deeper into the multifaceted role of a Financial Analyst, a position that demands a deep understanding of financial markets, coupled with the ability to analyze data effectively.

A Financial Analyst is responsible for evaluating financial data, trends, and market conditions to provide insights that drive business strategy. Their role extends beyond number crunching; they are strategic advisors, helping organizations make informed decisions to optimize financial performance.

What are the Financial Analyst Job Requirements?

To step into the role of a Financial Analyst, one needs to meet specific requirements that form the foundation for success. The journey involves continuous learning and gaining hands-on experience. Let’s explore the prerequisites to embrace the role of a Financial Analyst:

- A Bachelor’s or Master’s degree in Finance, Accounting, Economics, or a related field, showcasing a strong foundation in financial principles.

- Proficient in financial modeling and analysis, demonstrating the ability to interpret complex data and draw meaningful conclusions.

- Experience in budgeting, forecasting, and variance analysis, showcasing a track record of financial management.

- Excellent communication skills, both written and verbal, to convey financial insights to stakeholders effectively.

- Advanced proficiency in Excel and financial software, essential tools in the Financial Analyst’s toolkit.

- Adaptability and attention to detail, critical traits in the fast-paced and detail-oriented field of finance.

Securing additional certifications such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) can significantly enhance your profile in the competitive job market.

What are the Responsibilities of a Financial Analyst?

The role of a Financial Analyst is diverse, encompassing a range of responsibilities that contribute to the financial health of an organization. Let’s unravel the core responsibilities that define this role:

- Conducting financial analysis, interpreting data, and providing insights to support strategic decision-making.

- Preparing financial reports, including budgeting, forecasting, and variance analysis, to guide management in financial planning.

- Evaluating investment opportunities and providing recommendations based on risk assessment and financial projections.

- Monitoring economic trends and industry developments to anticipate potential impacts on the organization’s financial performance.

- Collaborating with cross-functional teams to gather financial information and ensure alignment with organizational goals.

- Presenting financial findings to stakeholders, translating complex data into comprehensible insights for non-financial audiences.

- Ensuring compliance with financial regulations and industry standards to mitigate risks and maintain the organization’s financial integrity.

Each responsibility is a thread in the tapestry of financial success, requiring a unique set of skills and a strategic mindset.

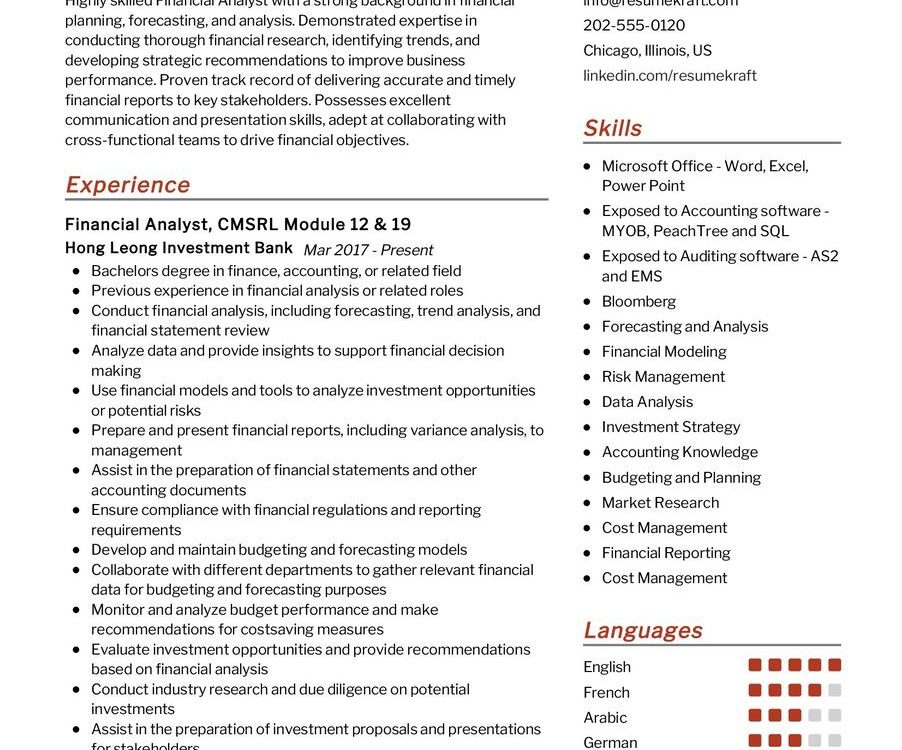

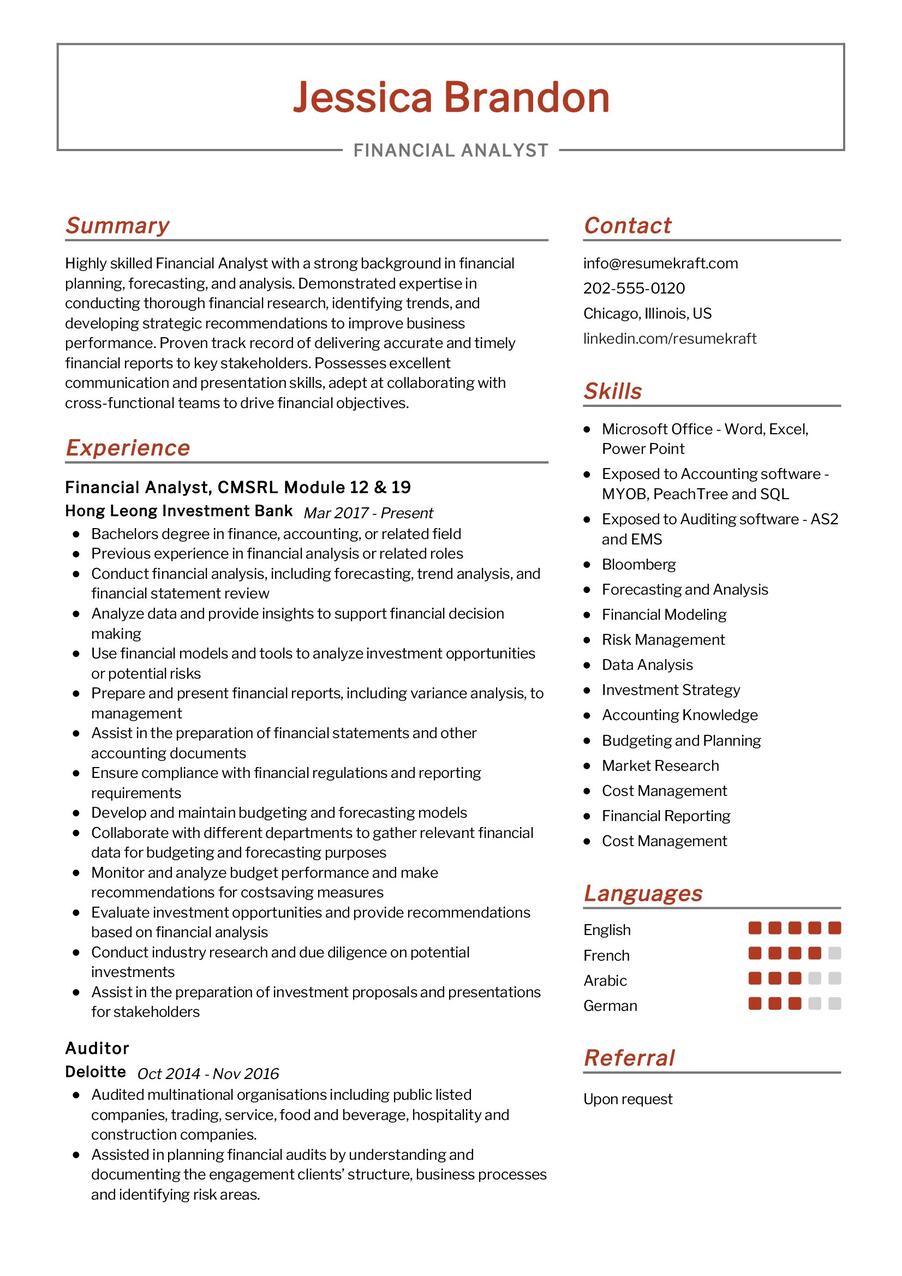

Financial Analyst CV Writing Tips

Crafting a CV that stands out in the competitive finance industry is an art. Your CV is not just a document; it is your professional story, showcasing your skills and experiences. Here are some tips to help you create a compelling Financial Analyst CV:

- Highlight your financial modeling skills, showcasing instances where your analysis led to informed decision-making.

- Detail specific financial projects you have spearheaded, narrating the impact they had on the organization’s financial health.

- Include quantifiable achievements, using metrics to demonstrate the results of your financial analyses.

- List relevant certifications, showcasing your commitment to continuous learning and professional development.

- Personalize your CV for the specific role, aligning your experiences with the job description and requirements.

Each tip is a brushstroke, helping you paint a portrait that is both compelling and authentic.

Financial Analyst CV Summary Examples

Your CV summary is the opening act of your professional story, setting the stage for what is to follow. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Results-driven Financial Analyst with over 5 years of experience, adept at financial modeling and analysis, contributing to a 15% increase in company profitability.”

- “Detail-oriented Financial Analyst specializing in budgeting and forecasting, with a proven track record of streamlining financial processes and reducing operational costs.”

- “Experienced Financial Analyst with expertise in risk assessment and investment analysis, providing strategic financial guidance to support organizational growth.”

Each summary is a window to your professional journey, offering a glimpse of your skills, experiences, and your vision as a Financial Analyst.

Create a Strong Experience Section for Your Financial Analyst CV

Your experience section is the heart of your CV, pulsating with the rich experiences you have gathered over the years. It is a space where you narrate your professional story, highlighting the milestones and the learning. Here are some examples to guide you:

- “Led financial analysis for a Fortune 500 company, contributing to successful budget planning and a 10% increase in shareholder value.”

- “Developed and implemented a robust financial reporting system, improving data accuracy and facilitating quicker decision-making.”

- “Collaborated with the finance team to conduct in-depth market research, leading to the identification of new revenue streams and business opportunities.”

Each experience is a chapter in your professional book, narrating tales of challenges met, solutions found, and successes achieved.

Sample Education Section for Your Financial Analyst CV

Your educational journey is the foundation upon which your career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning. Here’s how you can list your educational milestones:

- Master of Finance, XYZ University, a journey of deep learning and specialization, 2018.

- Bachelor of Business Administration in Accounting, ABC University, the foundation stone of your finance career, 2014.

- Chartered Financial Analyst (CFA) Level 2, a recognition of your advanced financial analysis skills, 2019.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your finance career.

Financial Analyst Skills for Your CV

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Financial Analyst should possess:

Soft Skills:

- Analytical thinking, the ability to dissect complex financial data and draw meaningful conclusions.

- Communication and interpersonal skills, the art of conveying financial insights effectively and building strong relationships.

- Attention to detail, the meticulous approach to ensuring accuracy in financial reporting and analysis.

- Time management, the skill to prioritize tasks and meet tight deadlines in a fast-paced environment.

- Problem-solving abilities, the knack of finding solutions to financial challenges.

Hard Skills:

- Advanced Excel skills, essential for financial modeling and data analysis.

- Proficiency in financial software, such as SAP or Oracle, to streamline financial processes.

- Knowledge of financial regulations, ensuring compliance with industry standards.

- Budgeting and forecasting expertise, critical for strategic financial planning.

- Experience with data visualization tools, enhancing the presentation of financial insights.

Each skill is a tool, aiding you in providing valuable financial insights and contributing to the success of your organization.

Most Common Mistakes to Avoid When Writing a Financial Analyst CV

As you craft your CV, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream job. Here we list down the mistakes often seen in CVs and how to avoid them:

- Using a generic CV for every application, a strategy that fails to showcase your unique fit for each role.

- Focusing on duties rather than achievements, resulting in a CV that lacks impact and depth.

- Overlooking the importance of a cover letter, a missed opportunity to showcase your personality and passion for the role.

- Using overly technical language, potentially alienating non-finance professionals who review CVs.

- Neglecting to proofread, a mistake that can leave a negative impression on potential employers.

Each mistake is a pitfall; avoid them to craft a CV that is both authentic and compelling.

Key Takeaways for Your Financial Analyst CV

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Financial Analyst CV:

- Emphasize your financial modeling skills, showcasing their impact on informed decision-making.

- Highlight specific financial projects you have led, demonstrating your contribution to organizational financial health.

- Quantify your achievements, using metrics to illustrate the results of your financial analyses.

- Include a section on continuous learning, showcasing certifications and courses that enhance your financial expertise.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Financial Analyst job interview.