Understanding the Role of a Lead Class Underwriter

As the financial landscape continues to evolve, the role of a Lead Class Underwriter has become increasingly crucial in the insurance industry. This position demands a unique blend of analytical skills, risk assessment expertise, and leadership capabilities. Let’s delve deeper into the multifaceted role of a Lead Class Underwriter, a position that requires a deep understanding of underwriting principles combined with effective team management.

A Lead Class Underwriter is responsible for overseeing the underwriting process, ensuring that insurance policies are accurately and efficiently evaluated. This role involves not only assessing risk and determining policy terms but also leading a team of underwriters to achieve organizational goals. The Lead Class Underwriter plays a pivotal role in maintaining a balance between risk management and business growth, making strategic decisions that impact the overall success of the underwriting team.

Key Requirements for a Lead Class Underwriter

Becoming a Lead Class Underwriter requires meeting a series of specific requirements, a journey that demands both technical expertise and leadership skills. Let’s explore the prerequisites needed to embrace the role of a Lead Class Underwriter:

- A Bachelor’s or Master’s degree in Finance, Business Administration, or a related field, showcasing a strong foundation in the financial domain.

- Profound knowledge of underwriting principles, including risk assessment, policy evaluation, and industry regulations.

- Experience in underwriting, demonstrating a trajectory of increasing responsibility and successful risk management.

- Leadership and managerial skills, honed through experiences and possibly through courses and certifications.

- Excellent communication skills to convey complex underwriting decisions to both internal teams and external clients.

- Proficiency in data analysis tools and software, essential for making informed underwriting decisions.

- Ability to work under pressure and meet tight deadlines, a trait developed over years of working in the dynamic insurance industry.

Securing additional certifications in underwriting or related financial fields can enhance your profile in the competitive job market.

Responsibilities of a Lead Class Underwriter

The role of a Lead Class Underwriter is a tapestry of varied responsibilities, woven with threads of technical expertise, leadership skills, and strategic vision. Let’s unravel the core responsibilities that define this role, each one contributing to the success of the underwriting team:

- Overseeing the underwriting process, ensuring accurate risk assessment and policy evaluation.

- Leading and mentoring a team of underwriters, fostering a collaborative and efficient work environment.

- Making strategic underwriting decisions that align with organizational goals and risk management strategies.

- Collaborating with other departments, such as sales and marketing, to ensure cohesive business operations.

- Staying updated on industry trends and regulations, guiding the team to adapt to changes in the insurance landscape.

- Conducting training sessions for the underwriting team, fostering a culture of continuous learning and development.

- Ensuring compliance with industry regulations and company policies, safeguarding the integrity of underwriting processes.

Each responsibility comes with its own set of challenges and learning, shaping you into a leader in the field of underwriting.

Lead Class Underwriter CV Writing Tips

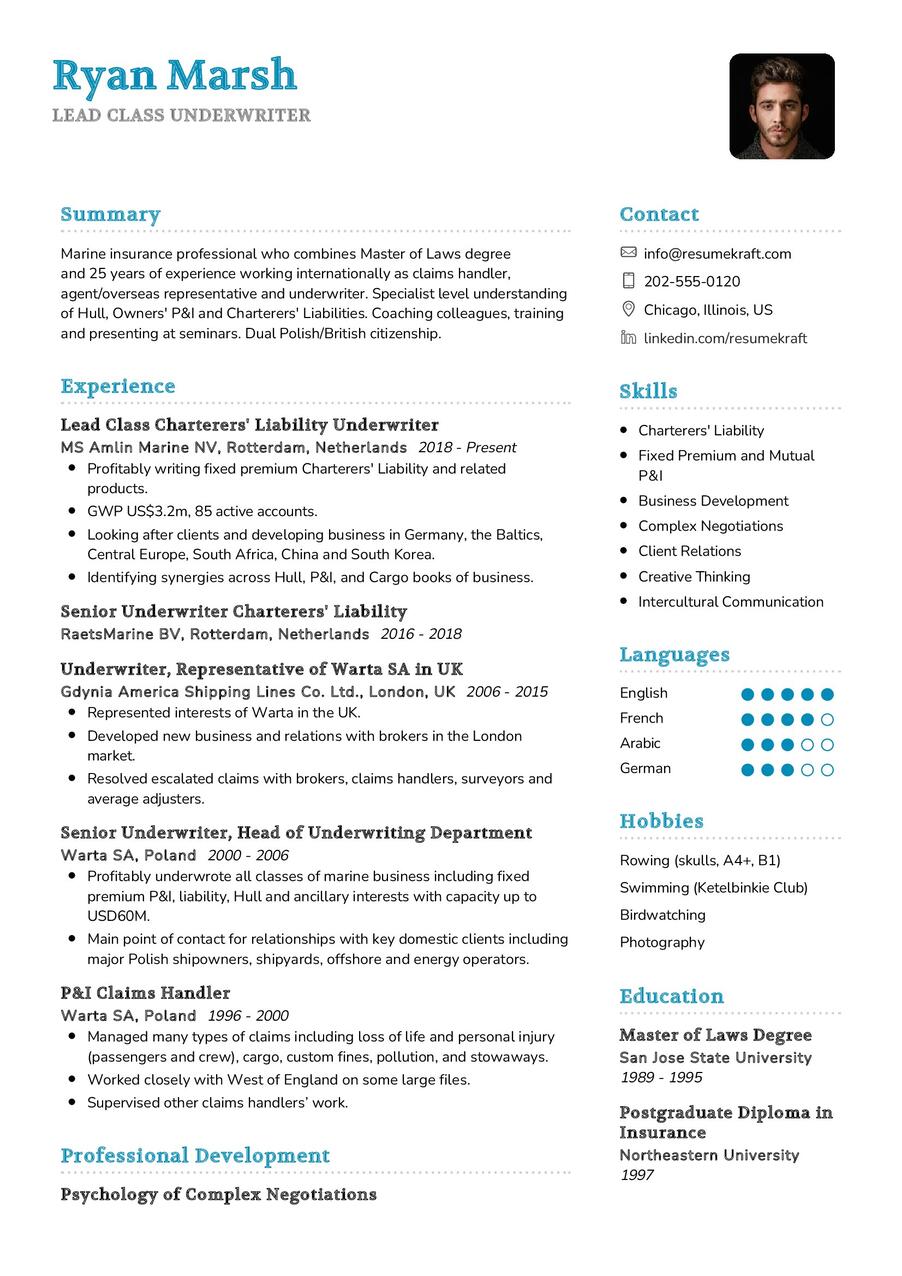

Your CV is a crucial tool in presenting your qualifications and experiences as a Lead Class Underwriter. Here are some tips to help you craft a CV that stands out in the competitive job market:

- Highlight your leadership roles, showcasing instances where you have led underwriting teams to success.

- Detail strategic initiatives or programs you have spearheaded, narrating the impact they had on the organization’s underwriting processes.

- Include metrics to quantify your achievements, such as successful risk assessments, policy improvements, or team efficiency enhancements.

- List relevant certifications, showcasing your commitment to continuous learning in the field of underwriting.

- Personalize your CV for the specific role, emphasizing your unique qualifications and fit for the Lead Class Underwriter position.

Each tip is a brushstroke, helping you paint a compelling and authentic picture of your underwriting expertise.

Lead Class Underwriter CV Summary Examples

Your CV summary is the opening act of your career story, setting the stage for what is to follow. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the underwriting table. Here are some examples to inspire you:

- “Lead Class Underwriter with over 10 years of experience, a visionary in risk management, adept at leading underwriting teams and implementing innovative strategies.”

- “Dedicated Lead Class Underwriter with a proven track record in successful policy evaluations, a strategic thinker who has enhanced underwriting processes for optimal efficiency.”

- “Experienced Lead Class Underwriter with a specialization in data-driven risk assessment, a leader fostering a collaborative and innovative underwriting team environment.”

Each summary is a window to your career, offering a glimpse of your journey, your strengths, and your vision as a Lead Class Underwriter.

Create a Strong Experience Section for Your Lead Class Underwriter CV

Your experience section is the heart of your CV, pulsating with the rich experiences you have gathered over the years. It is a space where you narrate your career story, highlighting the milestones and the learning. Here are some examples to guide you:

- “Led a team of underwriters in a high-paced insurance department, a journey of leadership where we achieved a 15% improvement in policy evaluation accuracy.”

- “Pioneered the implementation of data analytics in underwriting, a step towards efficiency improvement, streamlining processes and improving risk assessment.”

- “Developed and led training programs for the underwriting team, a nurturing ground for underwriters, enhancing skills and knowledge in risk management.”

Each experience is a chapter in your career book, narrating tales of challenges met, solutions found, and successes achieved in the world of underwriting.

Sample Education Section for Your Lead Class Underwriter CV

Your educational journey is the foundation upon which your career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning. Here’s how you can list your educational milestones:

- Master of Business Administration in Finance, XYZ University, a journey of deep learning and specialization, 2018.

- Bachelor of Science in Risk Management, ABC University, the foundation stone of your underwriting career, 2012.

- Certified Professional Underwriter (CPU) designation, a recognition of your expertise in underwriting, 2019.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your career as a Lead Class Underwriter.

Lead Class Underwriter Skills for Your CV

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Lead Class Underwriter should possess:

Soft Skills:

- Leadership and team management, the ability to steer your underwriting team towards success.

- Communication and interpersonal skills, the art of conveying underwriting decisions effectively and building strong relationships with clients and team members.

- Problem-solving abilities, the knack of finding solutions in challenging risk assessment situations.

- Attention to detail, the meticulous approach to ensuring accurate policy evaluations.

- Adaptability and resilience, the strength to bounce back and adapt to changing underwriting scenarios.

Hard Skills:

- Data analysis expertise, a deep understanding of using data to inform underwriting decisions.

- Proficiency in underwriting software, a skill that brings efficiency to the underwriting process.

- Knowledge of insurance regulations, an understanding that ensures compliance and safeguards the interests of both the company and clients.

- Budget and resource management, the acumen to manage underwriting resources efficiently.

- Project management, the ability to oversee underwriting projects from inception to completion successfully.

Each skill is a tool, aiding you in providing exceptional underwriting services and leading your team effectively.

Most Common Mistakes to Avoid When Writing a Lead Class Underwriter CV

As you craft your CV, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream Lead Class Underwriter position. Here we list down the mistakes often seen in CVs and how to avoid them:

- Using a one-size-fits-all approach, a strategy that fails to showcase your unique fit for the Lead Class Underwriter role.

- Listing job duties without showcasing your achievements, a narrative that lacks depth and impact.

- Ignoring the cover letter, a missed opportunity to narrate your story and connect with potential employers.

- Overloading your CV with technical jargon, a strategy that can obscure your true value to underwriting teams.

- Failing to proofread, a mistake that can leave a dent in your professional image.

Each mistake is a pitfall, avoid them to craft a CV that is both authentic and compelling.

Key Takeaways for Your Lead Class Underwriter CV

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Lead Class Underwriter CV:

- Emphasize your leadership journey, showcasing the milestones achieved and the underwriting teams led.

- Highlight your technical proficiency, showcasing your expertise in underwriting principles and data analysis.

- Detail the strategic initiatives you have spearheaded, painting a picture of your visionary approach to risk management.

- Include a section on continuous learning, showcasing the certifications and courses undertaken to stay at the forefront of the underwriting field.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Lead Class Underwriter job interview.