Exploring the Role of a Risk Manager

In today’s dynamic business environment, the role of a Risk Manager holds immense significance, acting as a guardian of financial stability and strategic decision-making. This position requires a unique blend of analytical skills, strategic thinking, and a deep understanding of potential risks that an organization may face. Let’s delve into the multifaceted role of a Risk Manager, examining the responsibilities, requirements, and skills that define this critical position.

What are the Job Requirements for a Risk Manager?

Embarking on the journey to become a Risk Manager entails meeting specific prerequisites, a path that demands a strong educational background and a comprehensive skill set. Let’s explore the key requirements for aspiring Risk Managers:

- A Bachelor’s or Master’s degree in Finance, Business Administration, or a related field, demonstrating a solid foundation in financial principles.

- In-depth knowledge of risk management frameworks and methodologies, showcasing an understanding of how to identify, assess, and mitigate risks.

- Experience in financial analysis, a journey where you have honed your skills in evaluating potential risks and proposing effective solutions.

- Strong leadership and communication skills, essential for conveying risk-related insights to stakeholders and leading risk management teams.

- Proficiency in relevant software and tools for risk assessment and financial modeling.

- Ability to stay updated with industry regulations and changes, ensuring compliance and informed decision-making.

Securing additional certifications in risk management, such as the Certified Risk Manager (CRM) designation, can enhance your profile in the competitive job market.

Responsibilities of a Risk Manager

The role of a Risk Manager is diverse, encompassing a range of responsibilities that are crucial for an organization’s financial well-being. Let’s unravel the core duties that define this role:

- Identifying and assessing potential risks that may impact the organization’s financial health and strategic objectives.

- Developing and implementing risk management policies and procedures to minimize exposure to identified risks.

- Collaborating with different departments to understand their risk profiles and providing strategic recommendations to mitigate risks effectively.

- Monitoring financial markets, industry trends, and regulatory changes to anticipate and respond to emerging risks.

- Conducting risk assessments and preparing reports for executive leadership, highlighting key risk indicators and mitigation strategies.

- Ensuring compliance with relevant laws and regulations related to risk management.

- Leading training sessions for employees on risk awareness and best practices in risk mitigation.

Each responsibility is a critical thread in the fabric of effective risk management, contributing to the overall resilience of the organization.

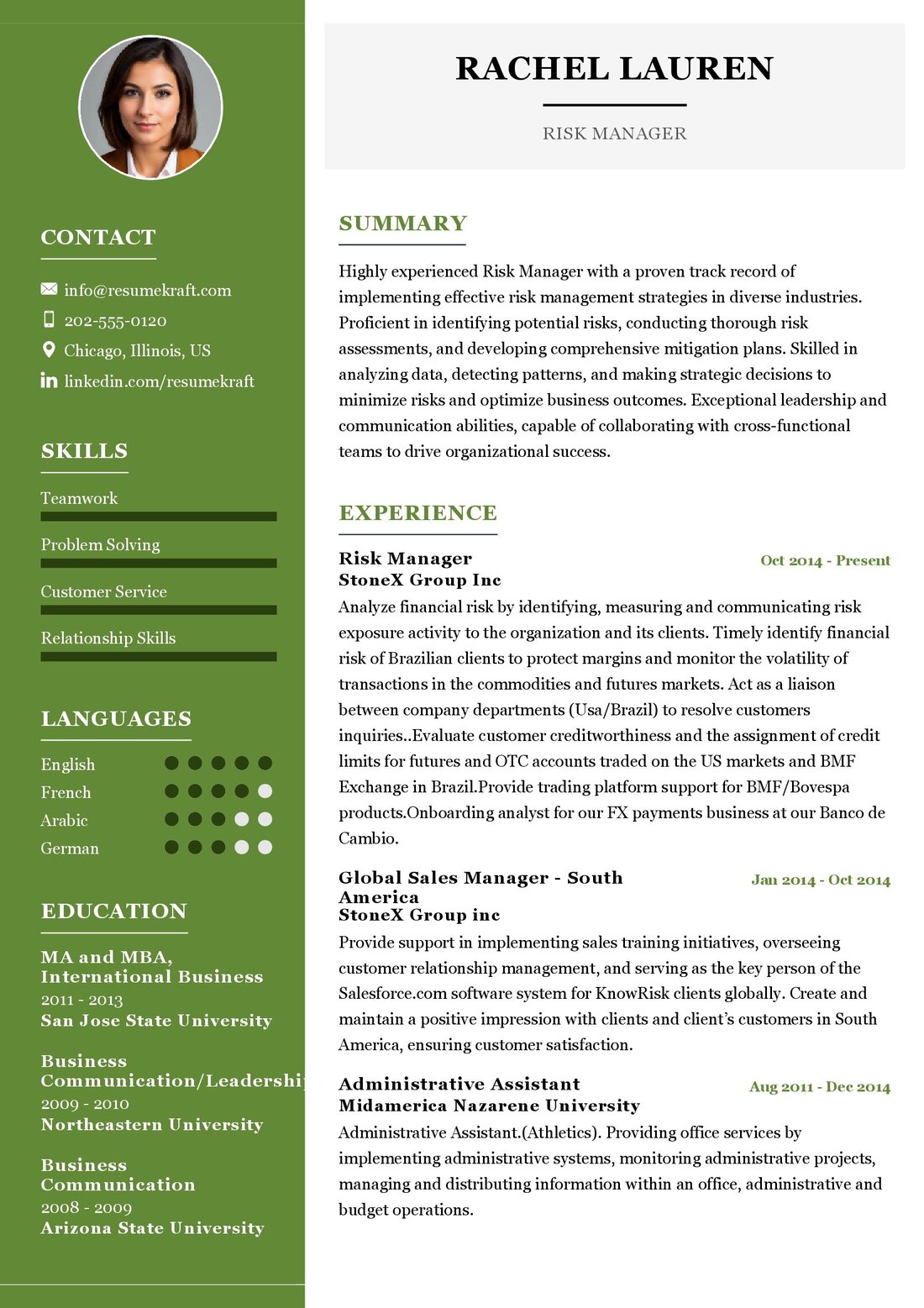

Risk Manager Resume Writing Tips

Crafting a compelling resume for the role of a Risk Manager is vital to stand out in a competitive job market. Here are some tips to help you create a resume that showcases your expertise and qualifications effectively:

- Highlight your experience in identifying and mitigating specific risks, quantifying the impact of your efforts where possible.

- Showcase your leadership skills by detailing instances where you led teams through successful risk management initiatives.

- Include specific examples of risk assessments you’ve conducted and the resulting improvements in the organization’s risk profile.

- Quantify your achievements, such as reducing financial losses or improving risk mitigation strategies, to demonstrate tangible results.

- Tailor your resume for the specific job by emphasizing the skills and experiences most relevant to the position.

Each tip is a brushstroke, helping you paint a resume that tells the story of your proficiency in managing risks and contributing to organizational success.

Risk Manager Resume Summary Examples

Your resume summary is the gateway to your professional story, providing a snapshot of your skills and accomplishments. Here are some examples to inspire you:

- “Results-driven Risk Manager with a proven track record in identifying and mitigating financial risks, leading teams to achieve a 15% reduction in overall risk exposure.”

- “Experienced Risk Manager skilled in developing and implementing robust risk management strategies, contributing to a resilient and financially sound organization.”

- “Strategic Risk Manager with a comprehensive understanding of market trends and regulations, adept at steering organizations through complex risk landscapes.”

Each summary is a window into your career, offering a glimpse of your accomplishments and expertise in risk management.

Create a Strong Experience Section for Your Risk Manager Resume

Your experience section is the narrative of your professional journey, showcasing your growth and impact. Here are some examples to guide you:

- “Led a cross-functional team in identifying and mitigating operational risks, resulting in a 25% decrease in financial losses over two fiscal quarters.”

- “Developed and implemented a comprehensive risk management framework, ensuring compliance with industry regulations and reducing overall risk exposure by 20%.”

- “Conducted regular risk assessments and implemented preventive measures, contributing to a flawless regulatory audit and recognition for risk management excellence.”

Each experience is a chapter in your professional story, illustrating your contributions to risk management and organizational success.

Education Section for Your Risk Manager Resume

Your educational background serves as the foundation for your expertise in risk management. Here’s how you can present your academic achievements:

- Master of Business Administration (MBA) in Finance, XYZ University, equipped with advanced financial knowledge and strategic thinking, 2015.

- Bachelor of Science in Business Administration, ABC University, laying the groundwork for a successful career in risk management, 2012.

- Certified Risk Manager (CRM), demonstrating a commitment to continuous learning and staying updated with the latest industry practices, 2017.

Each educational milestone is a testament to your dedication to building a strong foundation for your career in risk management.

Risk Manager Skills for Your Resume

Your skill set is the toolbox that equips you to navigate the intricate landscape of risk management. Let’s list down the essential skills that a Risk Manager should possess:

Soft Skills:

- Strategic thinking and decision-making, essential for devising effective risk management strategies.

- Leadership and team management, crucial for guiding teams through complex risk scenarios.

- Communication and interpersonal skills, vital for conveying risk-related insights to stakeholders effectively.

- Problem-solving abilities, the knack for finding innovative solutions to mitigate risks.

- Attention to detail, ensuring thorough risk assessments and accurate decision-making.

Hard Skills:

- Financial analysis, a core skill for evaluating and quantifying financial risks.

- Knowledge of risk management frameworks and methodologies, essential for effective risk identification and mitigation.

- Proficiency in risk assessment tools and software, facilitating accurate risk analysis.

- Regulatory compliance, understanding and adherence to industry regulations to ensure legal and ethical risk management.

- Data analysis and modeling, utilizing data-driven insights to inform risk management strategies.

Each skill is a tool in your arsenal, enabling you to navigate the complex world of risk management with finesse.

Common Mistakes to Avoid When Writing a Risk Manager Resume

As you craft your resume, it’s crucial to steer clear of common pitfalls that can hinder your chances of securing a risk management position. Here are some mistakes to avoid:

- Avoid using generic terms; instead, tailor your resume to highlight specific achievements and skills relevant to risk management.

- Don’t merely list responsibilities; provide quantifiable achievements and outcomes to showcase the impact of your risk management efforts.

- Include a cover letter to complement your resume, seizing the opportunity to convey your passion for risk management and your fit for the position.

- Ensure your resume is accessible to non-experts by avoiding excessive technical jargon; instead, focus on clear and concise language.

- Proofread your resume meticulously to present a professional image and avoid any typos or errors that could undermine your credibility.

Avoiding these mistakes is crucial to crafting a compelling resume that effectively communicates your value as a risk management professional.

Key Takeaways for Your Risk Manager Resume

As we conclude this comprehensive guide, let’s recap the key points to keep in mind while crafting your Risk Manager resume:

- Emphasize your experience in identifying and mitigating specific risks, quantifying the impact of your efforts where possible.

- Showcase your leadership skills by detailing instances where you led teams through successful risk management initiatives.

- Include specific examples of risk assessments you’ve conducted and the resulting improvements in the organization’s risk profile.

- Quantify your achievements, such as reducing financial losses or improving risk mitigation strategies, to demonstrate tangible results.

- Tailor your resume for the specific job by emphasizing the skills and experiences most relevant to the position.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Risk Manager job interview.