Exploring the Role of an Account Receivable Process Analyst

In the dynamic realm of finance, the role of an Account Receivable Process Analyst stands out as a crucial link in ensuring the smooth flow of financial transactions within an organization. This position requires a unique blend of analytical skills, financial acumen, and process expertise. Let’s delve into the multifaceted responsibilities and requirements that define the role of an Account Receivable Process Analyst.

Account Receivable Process Analyst Job Requirements

Embarking on a career as an Account Receivable Process Analyst involves meeting specific requirements that showcase a combination of education, technical skills, and analytical prowess. Here’s a detailed look at the prerequisites for excelling in this role:

- A Bachelor’s or Master’s degree in Finance, Accounting, or a related field, establishing a strong foundation in financial principles.

- Proficient knowledge of accounting software and financial systems, with a focus on accounts receivable processes.

- Experience in analyzing financial data, identifying trends, and generating meaningful insights for decision-making.

- Excellent communication skills, both written and verbal, to collaborate effectively with cross-functional teams.

- Attention to detail and strong organizational skills, crucial for managing and reconciling complex financial records.

- Ability to adapt to evolving financial regulations and industry standards.

Securing additional certifications in financial analysis and accounting software can significantly enhance your profile in the competitive job market.

Responsibilities of an Account Receivable Process Analyst

The role of an Account Receivable Process Analyst is a tapestry of responsibilities, combining financial expertise with analytical insights. Here are the core responsibilities that define this role:

- Analyzing and reconciling financial statements to ensure accuracy and compliance with accounting standards.

- Monitoring and managing accounts receivable processes, identifying areas for improvement and implementing solutions.

- Collaborating with finance and accounting teams to streamline financial workflows and optimize cash flow.

- Generating reports and presenting financial data to key stakeholders, offering insights for strategic decision-making.

- Implementing and maintaining efficient billing and invoicing processes, minimizing errors and delays.

- Identifying and mitigating financial risks, ensuring the organization’s financial health and stability.

- Staying updated on industry trends and changes in financial regulations to adapt processes accordingly.

Each responsibility in this role contributes to the overall financial health and efficiency of the organization.

Account Receivable Process Analyst CV Writing Tips

Crafting a compelling CV as an Account Receivable Process Analyst requires a strategic approach to highlight your skills and experiences effectively. Here are some tips to help you create a standout CV:

- Emphasize your experience in analyzing and improving accounts receivable processes, showcasing specific achievements and results.

- Highlight your proficiency in using financial software and tools, demonstrating your ability to navigate complex financial systems.

- Quantify your accomplishments with specific metrics, such as percentage improvements in cash flow or reduction in billing errors.

- Include relevant certifications and training in financial analysis, showcasing your commitment to professional development.

- Customize your CV for each application, aligning your skills and experiences with the specific requirements of the role.

Remember, your CV is your personal marketing tool, and it should effectively communicate your value as an Account Receivable Process Analyst.

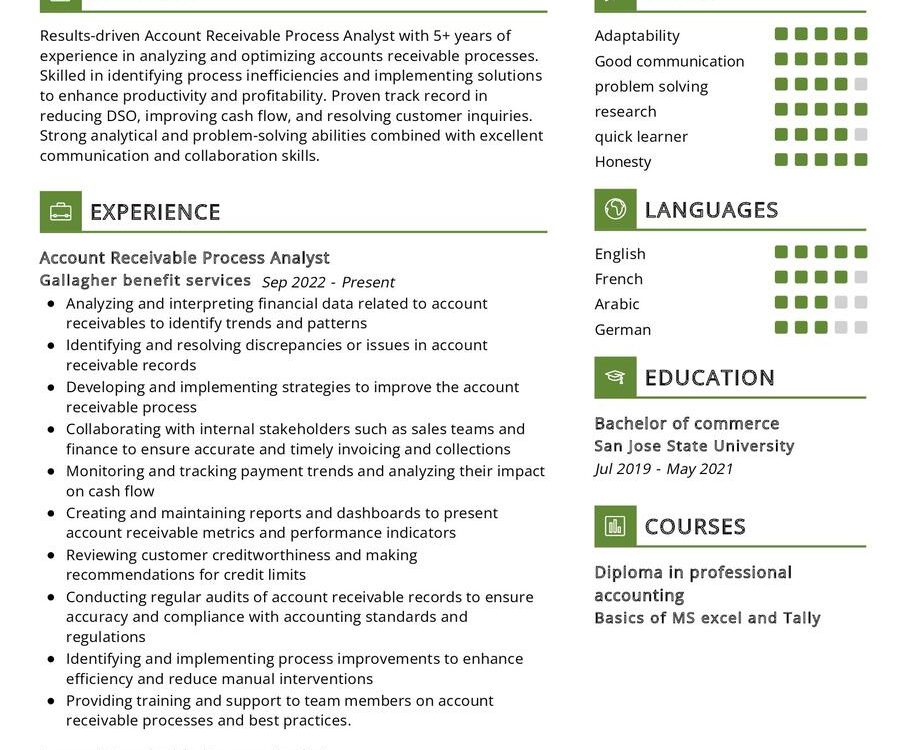

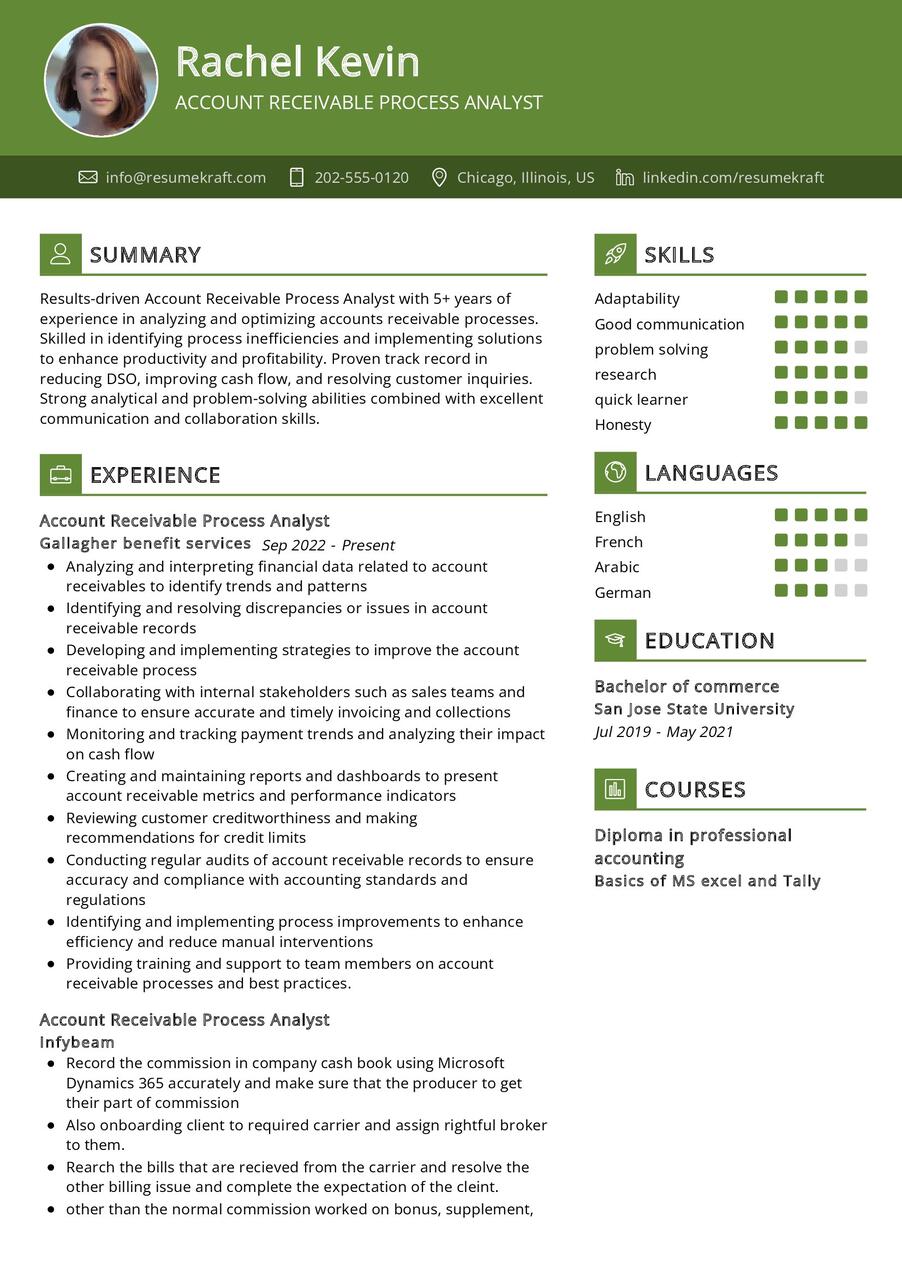

Account Receivable Process Analyst CV Summary Examples

Your CV summary is the opening statement that sets the tone for your entire CV. Craft a powerful summary that encapsulates your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Results-oriented Account Receivable Process Analyst with a proven track record in optimizing financial workflows, reducing errors by 15%, and improving cash flow efficiency.”

- “Detail-focused finance professional with expertise in accounts receivable processes, adept at implementing streamlined billing systems and enhancing financial reporting accuracy.”

- “Experienced Account Receivable Process Analyst with a strong analytical mindset, delivering actionable insights to drive strategic financial decisions and ensure regulatory compliance.”

Your CV summary should be concise yet impactful, giving recruiters a snapshot of your capabilities as an Account Receivable Process Analyst.

Create a Strong Experience Section for Your Account Receivable Process Analyst CV

Your experience section is the heart of your CV, providing a detailed narrative of your career journey. Here are some examples to guide you in crafting a robust experience section:

- “Led a team in analyzing accounts receivable processes, resulting in a 20% reduction in billing errors and a 10% improvement in cash flow efficiency.”

- “Implemented a new billing system that streamlined invoicing processes, reducing processing time by 25% and improving overall financial accuracy.”

- “Collaborated with cross-functional teams to develop and implement strategies for mitigating financial risks, ensuring compliance with industry regulations.”

Each experience should highlight your contributions and showcase your impact on the organization’s financial processes.

Sample Education Section for Your Account Receivable Process Analyst CV

Your educational background serves as the foundation for your expertise as an Account Receivable Process Analyst. Here’s how you can present your educational milestones:

- Master of Finance, XYZ University, an immersive program that provided in-depth knowledge of financial analysis and management, 2018.

- Bachelor of Business Administration in Accounting, ABC University, a comprehensive education in accounting principles and financial reporting, 2014.

- Certification in Financial Analysis, recognized by [Certification Authority], showcasing your commitment to continuous professional development, 2019.

Your education section should reflect your academic achievements and the specialized knowledge you bring to the role.

Account Receivable Process Analyst Skills for Your CV

Your skill set is your toolkit, showcasing the array of abilities that make you a competent Account Receivable Process Analyst. Let’s list down the essential skills for success in this role:

Soft Skills:

- Analytical thinking, the ability to interpret financial data and provide meaningful insights.

- Communication skills, both written and verbal, to convey complex financial information clearly.

- Attention to detail, ensuring accuracy in financial reporting and analysis.

- Time management, the skill to prioritize tasks and meet deadlines in a fast-paced financial environment.

- Team collaboration, fostering effective communication and cooperation with cross-functional teams.

Hard Skills:

- Proficiency in financial software such as [mention specific software], demonstrating your technical expertise.

- Knowledge of accounting principles and regulations, ensuring compliance in financial processes.

- Data analysis skills, utilizing tools to interpret and present financial trends and patterns.

- Problem-solving abilities, addressing financial discrepancies and implementing corrective measures.

- Adaptability, staying abreast of changes in financial regulations and industry standards.

Each skill in your toolkit contributes to your effectiveness as an Account Receivable Process Analyst.

Common Mistakes to Avoid When Writing an Account Receivable Process Analyst CV

While crafting your CV, it’s essential to steer clear of common mistakes that can impact your chances of landing the desired role. Here are some pitfalls to avoid:

- Avoid using a generic CV for different applications; tailor your CV to highlight skills and experiences relevant to each job description.

- Focus on achievements rather than job duties, providing recruiters with a deeper understanding of your impact in previous roles.

- Don’t underestimate the importance of a cover letter; use it as an opportunity to express your enthusiasm for the role and provide additional context to your CV.

- Ensure your CV is accessible to a wide audience by avoiding excessive use of technical jargon; make it comprehensible to both financial and non-financial professionals.

- Always proofread your CV to maintain a professional image and avoid typos or grammatical errors that can detract from your qualifications.

Avoiding these common mistakes will help you create a CV that effectively communicates your value as an Account Receivable Process Analyst.

Key Takeaways for Your Account Receivable Process Analyst CV

As you conclude your journey in crafting an impactful Account Receivable Process Analyst CV, keep these key takeaways in mind:

- Highlight your analytical skills and achievements in optimizing accounts receivable processes.

- Showcase your proficiency in financial software and tools, emphasizing your technical expertise.

- Detail the strategic initiatives you’ve led, offering a glimpse into your ability to drive positive financial outcomes.

- Include a section on continuous learning, featuring certifications and training that showcase your commitment to professional development.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Account Receivable Process Analyst job interview.

Armed with these insights and tips, you are now ready to craft a CV that is a true reflection of your journey, your skills, and your aspirations. Remember, your CV is not just a document; it is a canvas where you paint your career story, a story of growth, learning, and financial expertise. Best of luck!