Exploring the Vital Role of a Credit Manager

As financial landscapes continually evolve, the role of a Credit Manager becomes increasingly crucial in organizations worldwide. This position requires a unique blend of financial acumen, risk assessment skills, and leadership capabilities. In this comprehensive guide, we’ll delve into the multifaceted world of a Credit Manager, exploring their responsibilities, required qualifications, and the art of crafting an impressive Credit Manager CV.

What are the Credit Manager Job Requirements?

Embarking on the journey to become a Credit Manager demands meeting specific prerequisites, a path characterized by continuous learning and hands-on experience. Let’s dive deeper into the qualifications and skills needed to embrace the role of a Credit Manager:

- A Bachelor’s or Master’s degree in Finance, Accounting, Business Administration, or a related field, showcasing a solid foundation in financial principles.

- Profound knowledge of credit risk assessment, financial analysis, and relevant regulations.

- Experience in credit management, demonstrating a trajectory of increasing responsibility and successful risk mitigation.

- Leadership and managerial skills, honed through experiences and possibly through courses and certifications.

- Proficiency in financial modeling and credit evaluation techniques.

- Excellent communication and negotiation skills for effective interaction with clients and internal stakeholders.

- An analytical mindset with attention to detail, crucial for accurate risk evaluation.

- Adaptability and resilience, essential in navigating the dynamic landscape of credit management.

Securing additional certifications, such as Certified Credit Professional (CCP) or Credit Business Associate (CBA), can enhance your profile in the competitive job market.

Responsibilities of a Credit Manager

The role of a Credit Manager is a dynamic tapestry of responsibilities, weaving financial expertise, strategic thinking, and effective leadership. Let’s unravel the core duties that define this role, each contributing to the overall financial health and stability of an organization:

- Assessing the creditworthiness of individuals and businesses, utilizing financial statements, credit reports, and market trends.

- Developing and implementing credit policies and procedures to minimize risk and ensure compliance with regulations.

- Managing a team of credit analysts, providing guidance and fostering a collaborative work environment.

- Negotiating credit terms with clients and suppliers to strike a balance between risk and profitability.

- Monitoring and analyzing credit data, identifying potential risks and recommending preventive measures.

- Collaborating with sales and finance teams to understand business strategies and align credit decisions accordingly.

- Conducting regular portfolio reviews and risk assessments to optimize credit performance.

- Staying updated on industry trends and regulations, adapting credit strategies accordingly.

Each responsibility presents an opportunity for a Credit Manager to showcase their financial expertise and contribute to the organization’s success.

Credit Manager CV Writing Tips

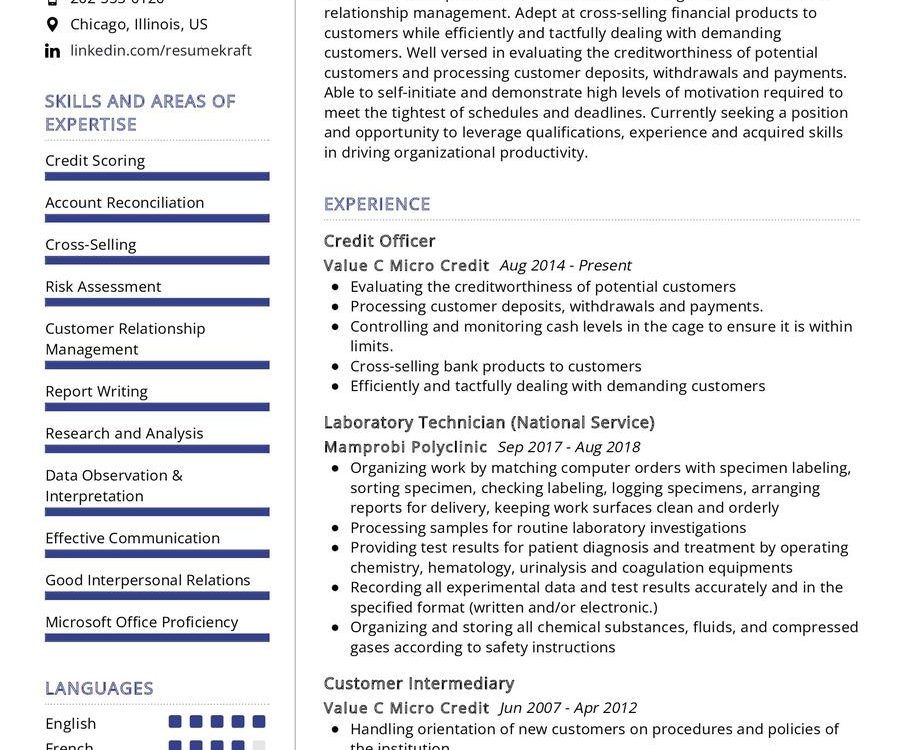

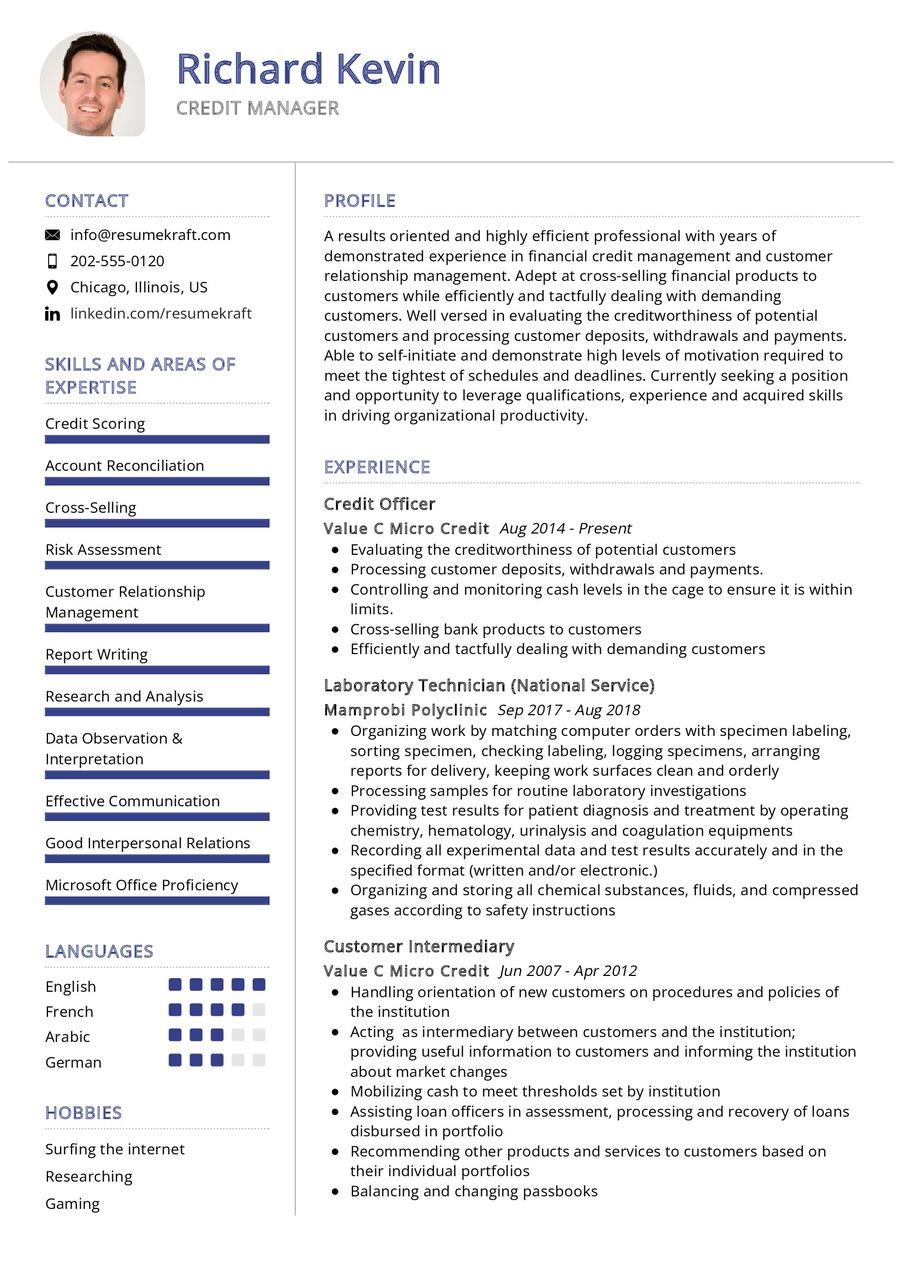

Crafting a CV that stands out in the competitive job market is an art. Your CV should not only showcase your qualifications but also narrate your story effectively. Here are some tips to help you create a compelling Credit Manager CV:

- Highlight leadership roles, showcasing instances where you have effectively managed credit teams.

- Detail initiatives or programs you have spearheaded, illustrating their impact on credit risk reduction and financial stability.

- Quantify your achievements, using metrics to highlight successful credit management strategies.

- List relevant certifications, demonstrating your commitment to continuous learning and professional development.

- Personalize your CV for the specific role, aligning your skills and experiences with the job description.

Each tip contributes to creating a CV that is not just a document but a narrative of your journey, skills, and vision as a Credit Manager.

Credit Manager CV Summary Examples

Your CV summary is the opening act of your career story, setting the stage for what follows. It should be a powerful snapshot of your journey, encapsulating your experiences, skills, and the value you bring to the table. Here are some examples to inspire you:

- “Experienced Credit Manager with over a decade in financial risk assessment, adept at leading teams and implementing strategies that have resulted in a 15% reduction in credit losses.”

- “Dedicated Credit Manager with a proven track record in developing and implementing credit policies, a strategic thinker who has successfully navigated challenging economic landscapes.”

- “Analytical Credit Manager with expertise in financial modeling and risk evaluation, committed to maintaining a balance between risk mitigation and business growth.”

Each summary is a window to your career, offering a glimpse of your journey, your strengths, and your vision as a Credit Manager.

Create a Strong Experience Section for Your Credit Manager CV

Your experience section is the heart of your CV, pulsating with the rich experiences you have gathered over the years. It is a space where you narrate your career story, highlighting milestones and learnings. Here are some examples to guide you:

- “Led a credit analysis team in a fast-paced financial institution, achieving a 20% improvement in risk assessment accuracy.”

- “Implemented a streamlined credit approval process, reducing the time taken for credit evaluations by 30%.”

- “Collaborated with sales teams to establish credit terms that contributed to a 25% increase in client satisfaction.”

Each experience is a chapter in your career book, narrating tales of challenges met, solutions found, and successes achieved.

Sample Education Section for Your Credit Manager CV

Your educational journey is the foundation upon which your career stands. It is a testimony to your knowledge, your expertise, and your commitment to learning. Here’s how you can list your educational milestones:

- Master of Business Administration (MBA) in Finance, XYZ University, a journey of deep learning and specialization, 2015.

- Bachelor of Science in Accounting, ABC University, the foundation stone of your financial career, 2012.

- Certified Credit Professional (CCP), a recognition of your expertise in credit management, 2016.

Each educational qualification is a stepping stone, leading you to the pinnacle of success in your career.

Credit Manager Skills for Your CV

Your skill set is your toolbox, equipped with a diverse range of tools that you have honed over the years. It is a showcase of your abilities, both innate and acquired. Let’s list down the essential skills that a Credit Manager should possess:

Soft Skills:

- Leadership and team management, the ability to steer your team towards successful credit management.

- Communication and negotiation skills, the art of conveying your thoughts effectively and building strong relationships.

- Problem-solving abilities, the knack of finding solutions in challenging credit scenarios.

- Attention to detail, the meticulous approach to ensuring accurate financial assessments.

- Adaptability and resilience, the strength to navigate dynamic credit landscapes.

Hard Skills:

- Financial modeling, a deep understanding of financial analysis and risk evaluation techniques.

- Knowledge of credit regulations, an understanding that ensures compliance and minimizes legal risks.

- Data analysis skills, the ability to interpret complex financial data for informed credit decisions.

- Proficiency in credit management software, a skill that enhances efficiency in credit operations.

- Strategic planning, the ability to develop and implement effective credit policies and procedures.

Each skill is a tool, aiding you in effective credit management and contributing to the financial success of your organization.

Common Mistakes to Avoid When Writing a Credit Manager CV

As you craft your CV, it is essential to steer clear of common pitfalls that can hinder your journey to landing your dream job. Here we list down the mistakes often seen in CVs and how to avoid them:

- Using a generic approach, a strategy that fails to showcase your unique fit for the Credit Manager role.

- Listing job duties without showcasing your achievements, a narrative that lacks depth and impact.

- Ignoring the cover letter, a missed opportunity to narrate your story and connect with potential employers.

- Overloading your CV with technical jargon, a strategy that can obscure your true value.

- Failing to proofread, a mistake that can leave a dent in your professional image.

Each mistake is a pitfall; avoid them to craft a CV that is both authentic and compelling.

Key Takeaways for Your Credit Manager CV

As we reach the end of this comprehensive guide, let’s recap the key points to keep in mind while crafting your Credit Manager CV:

- Emphasize your leadership journey, showcasing the milestones achieved and the teams led in credit management.

- Highlight your technical proficiency, showcasing your expertise in financial modeling and risk evaluation.

- Detail the strategic initiatives you have spearheaded, painting a picture of your visionary approach to credit management.

- Include a section on continuous learning, showcasing the certifications and courses undertaken to stay updated in credit management.

Finally, feel free to utilize resources like AI CV Builder, CV Design, CV Samples, CV Examples, CV Skills, CV Help, CV Synonyms, and Job Responsibilities to create a standout application and prepare for the Credit Manager job interview.