What is the Role of a Finance Professional?

Finance Professionals are the backbone of any organization, ensuring financial stability and steering the company towards economic growth and sustainability. They delve deep into the financial waters, analyzing data, predicting market trends, and making strategic decisions that significantly impact the organization’s future. Their role is multifaceted, encompassing budgeting, investment planning, risk management, and financial reporting, all while adhering to regulatory standards.

These professionals often collaborate with various departments, providing financial insights and guidance to align organizational objectives with financial goals. Their expertise in financial modeling, forecasting, and analysis is crucial in identifying investment opportunities and mitigating risks, ultimately contributing to the company’s long-term success and profitability.

What are the Finance Professional Job Requirements?

Being a Finance Professional requires a blend of education, skills, and experience. The foundational requirement is a bachelor’s degree in finance, accounting, economics, or a related field. However, the ever-evolving financial landscape often necessitates additional qualifications:

- Professional certifications such as CPA or CFA are highly valued and sometimes essential, depending on the role and employer.

- A master’s degree in finance or business administration can significantly enhance career prospects.

- Proficiency in financial software and databases is crucial for efficient and accurate work.

- Strong analytical, mathematical, and problem-solving skills are the bedrock of successful financial management.

- Excellent communication skills are vital for conveying complex financial concepts to individuals without a financial background.

What are the Responsibilities of a Finance Professional?

The responsibilities of a Finance Professional are diverse and integral to an organization’s success. They include:

- Financial Management: Overseeing financial resources to ensure optimal utilization and organizational growth.

- Data Analysis: Scrutinizing financial data and market trends to inform strategic decisions and identify areas for improvement and investment.

- Budget Development: Creating and maintaining budgets, ensuring alignment with organizational goals and financial health.

- Risk Mitigation: Identifying and addressing financial risks to safeguard the organization’s assets and reputation.

- Compliance: Ensuring adherence to financial regulations and standards, avoiding legal repercussions and fostering trust among stakeholders.

- Strategic Advising: Providing valuable financial insights and recommendations to senior management to drive the company’s success.

Finance Professional Resume Writing Tips

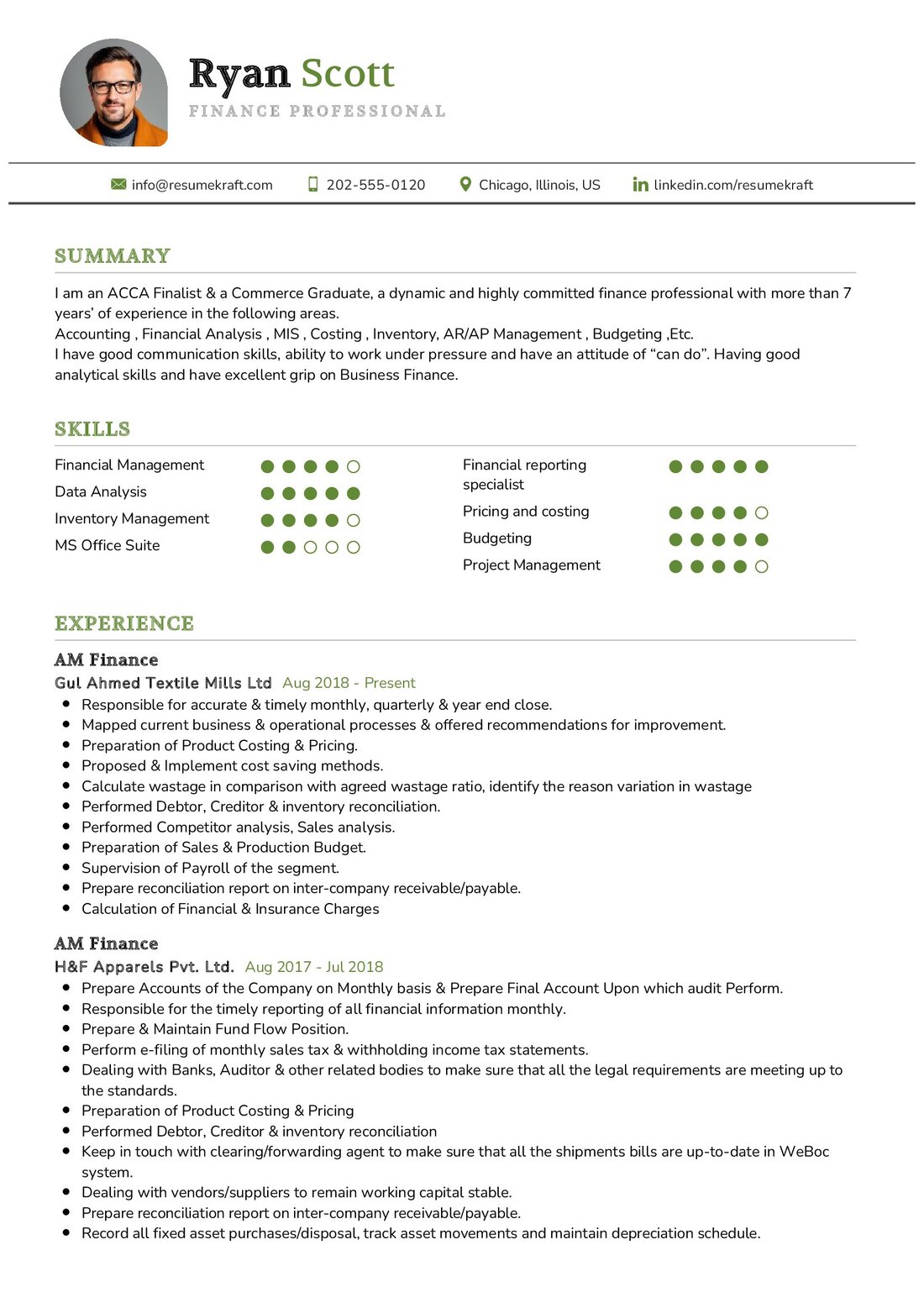

A compelling resume is a Finance Professional’s ticket to landing their dream job. Here are some tips to make your resume stand out:

- Quantify Achievements: Use numbers to highlight your accomplishments, such as percentage increase in revenue or amount of cost savings achieved.

- Highlight Technical Proficiency: Showcase your expertise in financial software, tools, and methodologies.

- Detail Specialized Skills: Emphasize skills like risk management, investment analysis, and financial modeling.

- Include Certifications: List relevant certifications to establish your credibility and expertise in the field.

- Use Action Verbs: Start bullet points with action verbs like “managed,” “analyzed,” and “developed” to convey your contributions effectively.

Finance Professional Resume Summary Examples

Your resume summary is the hook that encourages employers to read further. Craft it carefully to showcase your unique value proposition. Here are some examples:

- Strategic Finance Professional: With over a decade of experience in steering companies towards financial growth through meticulous analysis, strategic planning, and investment management. CPA certified with a master’s degree in finance.

- Results-Driven Financial Analyst: Specializing in data analysis, financial modeling, and forecasting. Proven track record of identifying cost-saving opportunities and optimizing investments to enhance profitability.

- Expert Finance Manager: With extensive experience in overseeing financial operations, developing budgets, and advising on financial best practices. Skilled in risk mitigation and regulatory compliance.

Create a Strong Experience Section for Your Finance Professional Resume

The experience section is where you showcase your career journey and accomplishments. Be specific and use quantifiable achievements:

- Financial Strategy Development: Formulated and executed financial strategies that increased annual revenue by 25%.

- Investment Management: Oversaw a diverse portfolio worth $100 million, achieving a 20% return on investment.

- Cost Reduction: Implemented cost-saving initiatives, resulting in a 15% reduction in operational expenses.

- Financial Advisory: Provided expert financial advice, contributing to the successful launch of three new product lines.

Sample Education Section for Your Finance Professional Resume

Education is a key component of a Finance Professional’s qualifications. Here’s an example of how to present it:

- MBA in Finance, Harvard Business School, Boston, MA, 2020

- Bachelor of Science in Accounting, University of Chicago, Chicago, IL, 2018

- Certified Public Accountant (CPA), AICPA, 2021

- Chartered Financial Analyst (CFA), CFA Institute, 2022

Finance Professional Skills for Your Resume

Highlighting a mix of soft and hard skills showcases your versatility and adaptability. Here are some examples:

Soft Skills:

- Leadership and Teamwork: Essential for collaborating with various departments and leading financial projects.

- Communication: Vital for explaining financial concepts and strategies to non-financial stakeholders.

- Problem Solving: Crucial for identifying and addressing financial challenges and opportunities.

- Time Management: Necessary for balancing multiple tasks and meeting deadlines.

Hard Skills:

- Financial Analysis and Forecasting: Fundamental for making informed financial decisions and planning for the future.

- Investment Strategies: Key for optimizing investment portfolios and achieving financial growth.

- Risk Management: Essential for identifying and mitigating financial risks.

- Financial Software Proficiency: Important for efficient and accurate financial management.

Most Common Mistakes to Avoid When Writing a Finance Professional Resume

Avoiding common mistakes can make your resume more compelling and professional. Here are some tips:

Key Takeaways for Your Finance Professional Resume

In conclusion, crafting a standout resume is crucial for Finance Professionals. Here are the key takeaways:

- Highlight your education, certifications, and relevant experiences.

- Emphasize both soft and hard skills, showcasing your versatility.

- Quantify your achievements and use action verbs to convey your contributions.

- Avoid common mistakes and customize your resume for each application.

With a well-crafted resume, you are well on your way to securing your next finance role. For additional resources and templates, visit Resumekraft.com.

Finally, feel free to utilize resources like AI Resume Builder, Resume Design, Resume Samples, Resume Examples, Resume Skills, Resume Help, Resume Synonyms, and Job Responsibilities to create a standout application and prepare for the Junior QA Tester job interview.